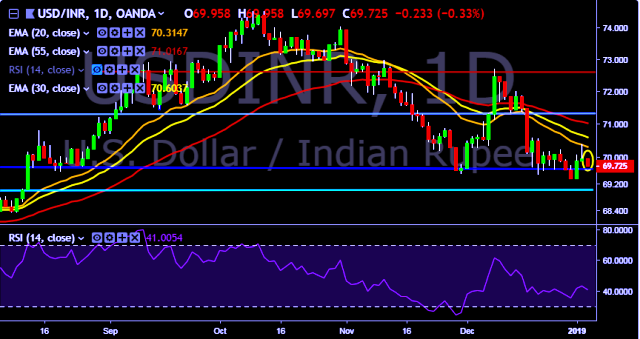

- USD/INR is currently trading around 69.75 marks.

- It made intraday high at 69.95 and low at 69.69 marks.

- Intraday bias remains bearish till the time pair holds key resistance at 70.57 mark.

- Key resistances are seen at 70.22, 70.57, 70.86, 71.06 and 71.48 marks respectively.

- On the other side, initial supports are seen at 69.47, 69.32, 69.02, 68.65 and 68.15 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads down and confirms the bearish trend in a daily chart.

- India’s NSE Nifty was trading around 0.36 percent higher at 10,711.22 points while BSE Sensex was trading 0.30 points higher at 35,682.58 points.

We prefer to take short position on USD/INR around 69.75, stop loss at 70.57 and target of 69.02.