Refer USD/JPY chart on Trading View

- USD/JPY is extending gains above 111 handle supported by broad-based US dollar strength.

- The remained stronger despite lower-than-expected US new home sales and PMI numbers.

- Firming prospects for a September Fed rate hike coupled with fresh concerns over the US-China trade policies was seen lending support.

- Better-than-expected Japanese CPI data has so far failed to put a bid under the JPY.

- Japan's CPI rose 0.9 percent year-on-year, beating the forecast of 0.4 percent growth by a big margin.

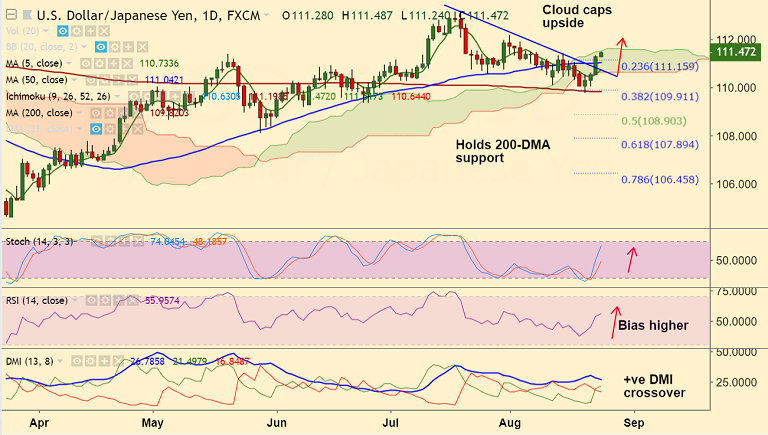

- Technical studies support further gains in the pair. Cloud offers immediate resistance at 111.51. We see scope for test of 112.15 on break above.

- 50-DMA at 111.04 is immediate support, break below to see weakness.

- The market focus now turns to the Jackson Hole symposium where central bankers and economists from around the world will gather.

- The main event will be a speech by Fed Chairman Jerome Powell at 1000 EST today.

Support levels - 111.04 (50-DMA), 110.73 (5-DMA), 109.82 (200-DMA)

Resistance levels - 111.51 (cloud top), 112, 112.15 (Aug 1st high)

Recommendation: Stay long on dips, SL: 111, TP: 112/ 112.15

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 63.9571 (Neutral), while Hourly JPY Spot Index was at -161.668 (Bearish) at 0425 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.