The Russian rouble had weakened earlier in the spring, driven jointly by a collapse of the oil price and collapse of world economic activity. But when both these factors stabilised, the currency was able to rally noticeably and this, in fact, drove the central bank to accelerate the pace of its rate cuts. CBR used a large 100bp rate cut step in June before reverting to the smaller 25bp step in July. The outlook for the oil price has also become risky because of second wave fears. As a result of such developments, modest rouble underperformance is to be expected in the near-term. We could foresee USDRUB at 72.00 levels by Q3’2020 end, but forecast the exchange rate to trade at around the 70.00 mark by the year-end.

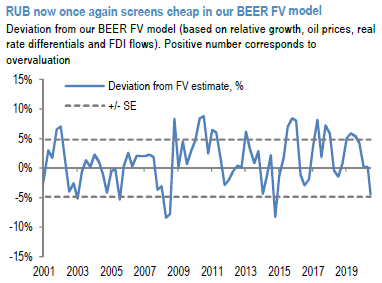

RUB should also benefit from an improved technical backdrop. Following the seasonal pressures, valuations once again appear attractive. We refer to JP Morgan’s BEER FV model that points to an undervaluation of around 3.4% (close to one standard deviation). This compares to an overvaluation of around 5%, when we first initiated tactical hedges (refer 1st chart). Ruble positioning remains relatively elevated in the latest J.P. Morgan client survey, with a score of +2.2 (ranking it the second largest EM FX OW in our survey).

However, we note higher frequency measures of spec positioning, as captured by IMM data, so positioning has been reduced over the past number of weeks (refer 2nd chart).

Accordingly, we saw this as an opportune time to take profits on USDRUB call spreads. With dividend pressure now abating and valuations once again screening cheap, positions have been squared-off and booked 0.86% of notional profit on tactical 1x1 USDRUB call spread (entry date: 30 June; spot ref of 71.74; exit spot ref of 74.01; option price at entry: 0.91%, option price at exit: 1.77%; profit: 0.86% of notional). We, now, maintain OW RUB in the GBI-EM model portfolio, expecting outperformance on an RV basis against fundamentally weaker high yielders in this region. Courtesy: JPM & Commerzbank

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts