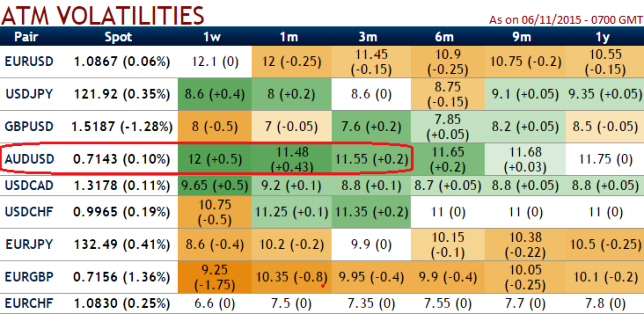

As you can make out from the diagram the implied volatility for near month at the money contracts of AUDUSD pair has been highest among G20 currency segment and is seen at around 11.5-12% levels for 1m-3m expiries.

We know that the options with a higher IV cost more, intuitively due to the higher likelihood of the market 'swinging' in your favour.

If IV increases and you are holding an option, this is good. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

Entering into the above recommended AUDJPY positions when implied volatility ticks at around 12% and expecting for the inevitable adjustment is a smart approach, regardless of the direction of price movement. Based on volatility and time decay, the strategy is a "price neutral" approach to options, and one that makes a lot of sense.

Considering the above aspects on speculating grounds, we recommend deploying one touch binary puts in our strategy in order to extract leverage on extended profitability.

The prime merits of such one touch option are high yields during high volatility plays. Wider spreads indicates lack of liquidity. The spreads for one touch AUD/USD options are constant time and barrier levels.

Usually, such binary options for every change in 1 pip the relative change in option price 0.01% or even exponential at high implied volatility times. You can see that in charts how every dips would propel Vega effects.

But on hedging grounds, by employing 2w At-The-Money vega put on long side and 3D ITM put on short side one can not only monitor the swings on either side but also multiplies returns by twice, thrice or even pour returns exponentially as vega on higher vols most likely to spike up. But do remember these are exclusively for hedging basis.

FxWirePro: Vega spreads for AUD/USD’s higher IVs

Friday, November 6, 2015 10:49 AM UTC

Editor's Picks

- Market Data

Most Popular