On the verge of US crude inventory level checks, WTI crude futures (CL1!) today was unable to break above resistance levels at 47.98 so far (yesterday's close and today's high), we think any breach below the supports at 47 levels would certainly drag this commodity until 42.22 levels.

Let's just suppose a hypothetical scenario contemplating prevailing downtrend of WTI crude.

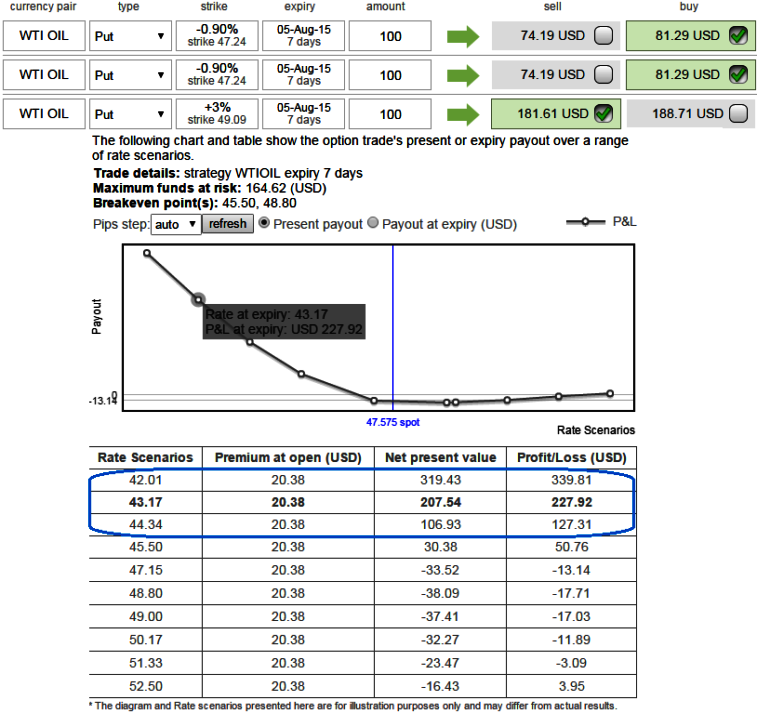

As shown in the diagram, Spot WTI oil is currently trading at $47.66. An options trader who is bearish on this commodity executes 2:1 put back-spread by shorting a near month 7D (3%) In-The-Money put for $181.61 and buying 2 lots of near month same 7D (-0.90%) Out-Of-The-Money -0.42 delta puts for $81.29 each for the net credit of $19.03 to enter the trade.

On expiration after 7 days, if WTI crude trades at around $47.24 levels, both the long puts expire worthless while the short put expires in the money with $500 in intrinsic value. Buying back this put to close the position will result in the maximum loss of $500 for the options trader.

If WTI crude dives to $42.22 level on expiration, all the options advocated above would expire in the money. The short side is worth $1000 and needs to be bought back to close the position. Since the two long puts were bought is now worth around $500 each, their combined value of around $1000 is just enough to offset the losses from the written put. Therefore, he achieves breakeven at $45.50.

Below $45.50 though, there will be no limit to the gains possible. For example, at $30, each long put will be worth $1500 while his single short side is only worth $2000, resulting in a net profit of $1000.

If the underlying commodity rallies towards $50 or higher at expiration, all the options involved will expire worthless. Since the net debit to put on this trade is zero, there is no resulting loss.

FxWirePro: WTI crude PRBS to arrest extended dips until 42.22

Wednesday, July 29, 2015 12:50 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary