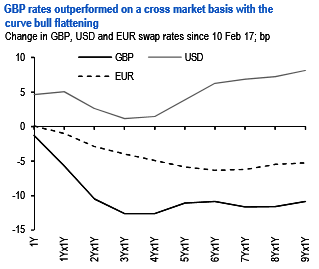

Gilt yields once again rallied this week and outperformed on a cross-market basis with the 2s/10s curve flattening as 10Y outperformed. In swap space, GBP forwards rallied more than 10bp on the week from greens out to 9Yx1Y (refer above chart).

Data this week does not explain the outperformance of UK rates, with Q4’16 GDP revised higher by one-tenth to 0.7% QoQ, driven by strength in manufacturing and ongoing consumer strength. The CBI retail sales survey modestly bounced in February but the relatively low level suggests some slowing in retail spending growth, with next week’s consumer confidence and credit data important to gauge how the consumer is tracking as inflation rises.

We think the outperformance in gilts is more position-driven, with risk-off dynamics and the rally in Euro rates resulting in a degree of short position squaring in gilts. Gilt future open interest has been climbing over the past month and although it is currently below the levels seen following the post-US election selloff current open interest is relatively high historically.

We note that open interest rose during the first few weeks of the year as 10Y yields sold-off but has continued to rise recently despite 10Y gilt yields rallying back to their lowest levels since early November (refer above chart).

We think the recent rally may reflect a degree of short covering, particularly given the growing consensus view to be short gilts and GBP swaps on a cross-market basis, and we see risks that a further rally in yields could trigger a further wave of position squaring.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand