FxWirePro, the official FX news and analysis service of MetaQuotes, Spotware and Currenex, has announced its launch of Currency Strength Index, which tracks the performance of the underlying currency versus a basket of leading global currencies in real-time. The strength of each Currency Index is calculated by using a proprietary algorithm which assigns weights by taking appropriate volumes into consideration with respect to others to get the overall Index strength. The Currency Strength Index is currently provided through APIs during trading sessions.

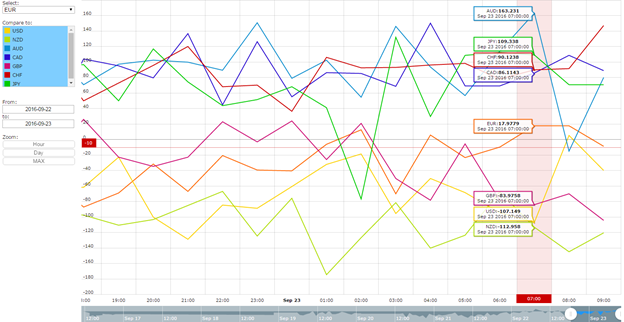

Currently available are the following Indices: USD Index, EUR Index, GBP Index, JPY Index, NZD Index, AUD Index, CHF Index and CAD Index.

How traders can use the Currency Strength Index for trading?

- USD -107.14 (Highly bearish) (above -100)

- EUR17.97

- GBP -83.9758 (slightly bearish) (above -75)

- AUD163.23 (Highly bullish) (above 100)

- NZD 112.95 (Highly bearish) (above -100)

- CAD 86.11 (slightly bullish)

- CHF 90.12 (slightly bullish)

- JPY 109.33 (Highly bullish) (above 100)

- Long on AUD and short on USD. (Buy AUD/USD)

- Long on AUD and short on NZD (Buy AUD/NZD)

- Long on JPY and short on USD (Sell USD/JPY)

- Long on CAD and short on GBP (Sell GBP/CAD (slightly bearish)

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns