Canadian wholesale data prints hinting on healthy business climate and we thereby recommend ratio spread as the pair is likely to remain either sideways or slightly bullish in our view.

Buying call spread in addition to selling more necked call options constitutes this hedging position.

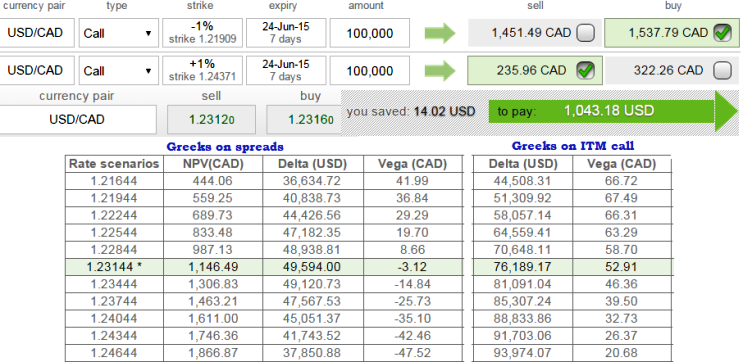

On long side current (1%) ITM delta calls indicate 0.76 and vega at 52.96, which signifies any implied volatility disrupts current bullish mood option premiums would be effected at CAD 52.96 for corresponding change in IV.

While combined delta is flashing at 0.49 which we think it as quite a lot reasonable as vega on combined position is at -3.12 that is not expected to make much noise even if any downside risks are intensified.

The portion should ideally be created in the ratio of 1:2 or aggressive traders can even extend it upto 1:3 with short time for expiry.

Breakeven will be at: short strike price + difference in strike price + net credit.

High leverage effects on USD/CAD vega spreads; long ITM calls and short OTM calls

Wednesday, June 17, 2015 1:21 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary