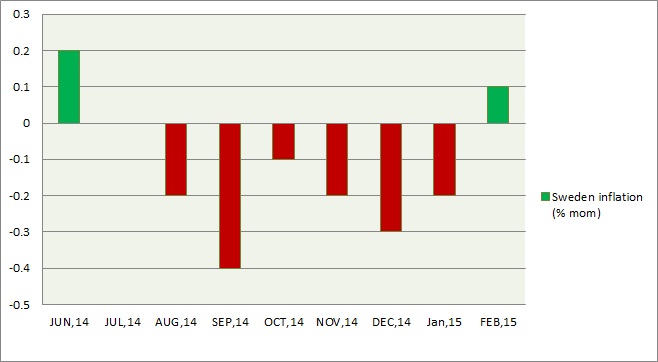

- Today Sweden's CPI print was positive after long six months of negative data.

- CPI increased by 0.1% mom and 0.7% YoY, positive but still very low for any conclusion.

- Nevertheless this a very positive comeback after price fall accelerated by - 1.1% last month on a yearly basis. Monthly CPI dropped to -0.2% in January.

Central Bank's stance -

- To fight deflation Sweden's Riskbank introduced negative rates earlier this year. Current repr rate is -0.10%.

- Riskbank also introduced asset purchase programme of 10 billion in local currency. The amount is small however the bank has explained that it is only an experimental introduction which may turn robust over coming meetings.

Analogy -

- Today's positive print may be interpreted by the Riskbank as a right direction for monetary.

- However as the print remains well below central bank's target of 2% inflation, the bank might act further on its promises and resort to balance sheet increase over the next policy meeting that is scheduled on 29th April 2015.

Swedish krona (SEK) is currently trading at 8.59 against dollar and further drop can't be ruled out due to divergent monetary policy. Swedish bonds could gain further over the anticipation of purchase.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?