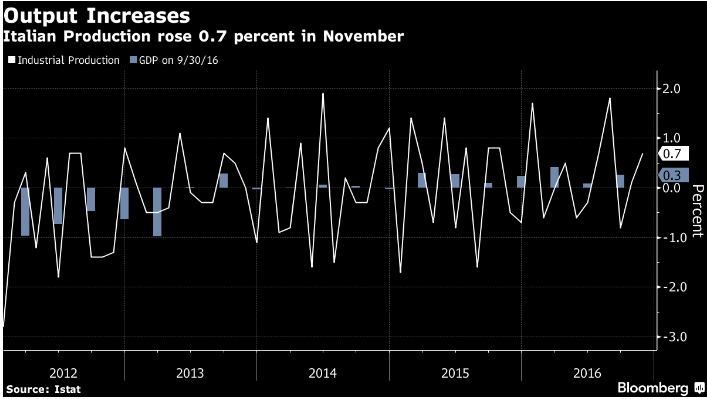

Italian industrial production rose 0.7 percent month-over-month in November, beating median forecast in Reuters poll for a 0.3 percent gain, national statistics bureau ISTAT reported on Thursday. Data compared to a revised 0.1 percent rise in the previous month. On an annual, work-day adjusted basis industrial output was up 3.2 percent in November. Output in the three months to November was up 0.9 percent compared with the June-to-August period.

Better-than-expected rise in Italian industrial production in November suggests a possible acceleration in economic activity. Separately, Istat reported last month Italy's manufacturing confidence index rose in December to the highest in a year. Istat’s leading indicator signalled an extension of Italy’s recovery with “a positive prospect of the economic growth pace in the next months,” the statistics agency said in a December 30 report.

Meanwhile, after a triple-dip recession between 2008 and 2014, Italy's industrial production has recovered only a small part of that over the last year. Latest indications from the labor market and inflation do not bode well for Italy’s outlook. Unemployment in Italy rose 11.9 percent in November, the highest in almost a year and a half. Inflation fell 0.1 percent last year on an annual basis, the first yearly decline since 1959 when the consumer-price index decreased 0.4 percent.

Three years of Renzi government has done little to lift the country out of stagnation. Following a failed referendum vote, Premier Matteo Renzi resigned last month. He was succeeded at the head of a new government by Paolo Gentiloni. Gentiloni, former foreign minister, took power amidst major banking crisis in Italy. Measures were initiated to rescue Italy's third-largest bank, Monte dei Paschi di Siena, and pledge as much as 20 billion euros ($21 billion) to prop up other lenders.

German Finance Minister Wolfgang Schaeuble said on Wednesday he had no doubt that Italy would stick to European bailout rules as Italian Economy Minister Pier Carlo Padoan had promised. German finance ministry last month expressed concern about Italian plans to rescue Monte dei Paschi di Siena and said Rome must stick to European rules for such bailouts.

EUR/USD was up 0.62 percent on the day. The pair was trading at 1.0646 at 11:50 GMT. Broad-based US dollar weakness after Trump's lack of conviction during the news conference overnight supporting EUR/USD higher. Technicals are supportive for further gains in the pair. The pair has broken 50-DMA at 1.0613 and is on track to test 100-DMA at 1.0867.

FxWirePro Currency Strength Index showed hourly EUR Spot Index was at 79.4684 (Slightly bullish) at 12:00 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record