Japan's economy contracted by 0.4% Q/Q in Q2 in "real" or inflation-adjusted terms, while on annual terms it fell 1.6 per cent, less than the 2.2 per cent fall expected, data released on Monday showed. While the drop was somewhat less severe-than-expected, it still showed that the Japanese economy is still struggling to achieve steady and sustainable recovery.

The world's third largest economy suffered a brief period of recession as recently as the middle of last year, and economists are becoming increasingly wary of predicting future trends, given the erratic pattern of recovery to date. However, PM Abe has committed to reflating the Japanese economy before the next CT hike (April 2017) through implementation of the growth strategy. In 2015, the movement which had temporarily stalled due to the CT hike in April 2014, will reaccelerate. As a result, wage increases and strong nominal GDP growth should lead to reflation of the economy.

Nominal GDP growth is above long-term interest rates for the first time since the end of the bubble economy, this indicates that the Japanese economy is finally at the start of a full-scale reflationary phase. Third-quarter growth is expected to show a rebound. Weather-related factors are also expected to have a marked impact on third-quarter GDP, but economists disagree over whether this will be net positive or net negative.

Since April, the beginning of the new fiscal year, Japan's corporates have been actively implementing their business plans, including in terms of capex. The unemployment rate has fallen below the level of NAIRU (3.5%), and strong aggregate wage growth looks set to spur consumption. Also, CPI has stalled on falling oil prices, while wages have been increasing since the start of the new fiscal year in April. As a result, real household income is recovering and consumer sentiment is now starting to improve. In addition, as the economic recovery in the US strengthens, Japanese exports should make a firm recovery ahead.

"Corporate activity and consumer spending are likely to strengthen, and we expect Q3 real GDP growth to return to positive growth", said Societe Generale in a report to its clients.

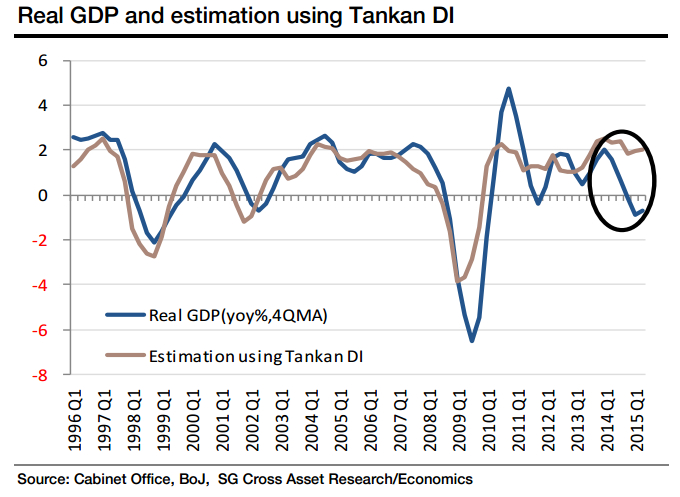

Firm economic sentiment supported by the policies of 'Abenomics' has been a driving force behind Japan's plan to exit deflation. However, the real economy (such as exports, production, and GDP growth) and inflation have been particularly weak compared to the strength of economic sentiment. Despite a weak real economy and inflation, the BoJ has of yet not implemented additional QQE measures. In case the situation continues, the government and the BoJ's strong commitment to achieve the 2% inflation target will be open to question.

"If the market and corporates become disappointed, economic sentiment will deteriorate and there will be no driving force to propel an exit from deflation. This could be a big risk to the Japanese economy. Against this backdrop, it is necessary for the government to continue to support the economic sentiment through policies until real economy and inflation will strengthen", added Societe Generale.

A 6 percent drop in Chinese stocks on Tuesday drove currency investors into safe-haven currencies such as the yen and the Swiss franc, albeit in thin volumes. The dollar fell 0.15 percent against the yen to trade at 124.25 yen.

Japan's Q3 GDP growth likely positive, economic sentiment firm but real economy and inflation weak

Tuesday, August 18, 2015 11:36 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand