On hedging front, the prevailing hot issues of Greece adds more pressure on Euro as Asian pairs started being choosy on Euro for cheap hedging cost perspectives.

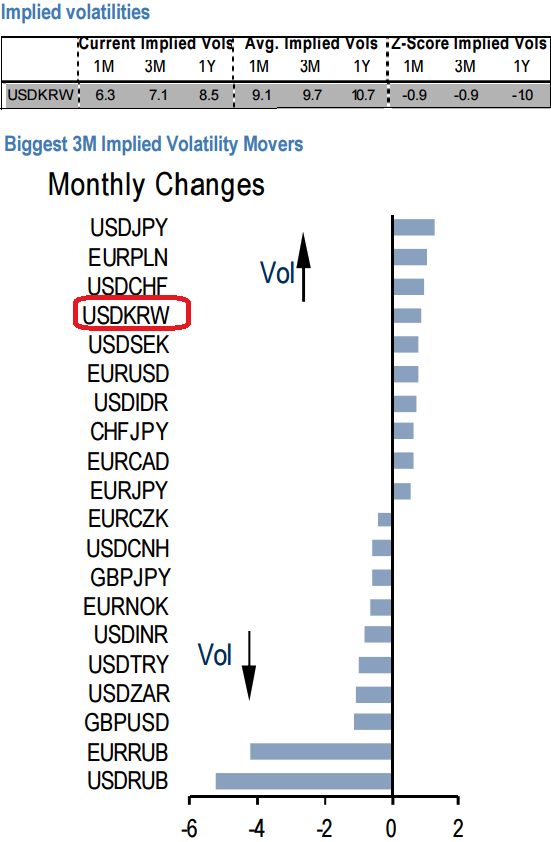

As shown in the nutshell it is figured out that from last month or so the implied volatility is increased to feature USDKRW in top 5 lists of IVs.

EUR/KRW imparts some distinctive exposure to a nasty Greek tail that could be valuable in light of upcoming event risks around the repayment of IMF monies.

Short KRW vol in EUR/KRW - USD/KRW vega spreads:

Vega is directly proportionate to the volatility. Vega for all options is always a positive number because options value increase in value when volatility increases and decrease in value when volatility declines.

USD/KRW vols have picked up this week on the back of the yen sell-off and screens rich in shorter dates with implied - realized risk premium around 1.5 pts.

On the verge of US Treasury scrutiny of Korean reserve accumulation, inadequacy of rate cuts in catalyzing capital outflows, KRW in our view would be the most resilient among the Asian currency baskets to risk shocks. due to the cushion of a 7% + current account surplus and there are decent odds that the won traces a broad range in coming weeks as official resistance and sympathetic weakness alongside yen collide with fundamentally bullish balance of payment factors.

We hedge away the risk of a systemic EM shakeout by pairing USD/KRW shorts with EUR/KRW longs.

We have seen better entry levels on the spread as a EUR-cross vol.

KRW eyes on Euro as a hedging alternative amid Grexit mess; IV adds fuel to chaos

Thursday, June 4, 2015 10:27 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate