GBP selling continues despite a decline in support among UK voters to leave the EU. GBP's price action suggests that the market is already worrying about the EU referendum and the associated threat of Brexit. Markets are bidding up downside risk against G10 and EM currencies at the fastest rate since the May 2010 general election. Deep polarisation of political and public opinion over Britain's relationship with the EU has raised the threat of a disorderly fall in the pound in the run-up to the EU in/out vote on 23 June.

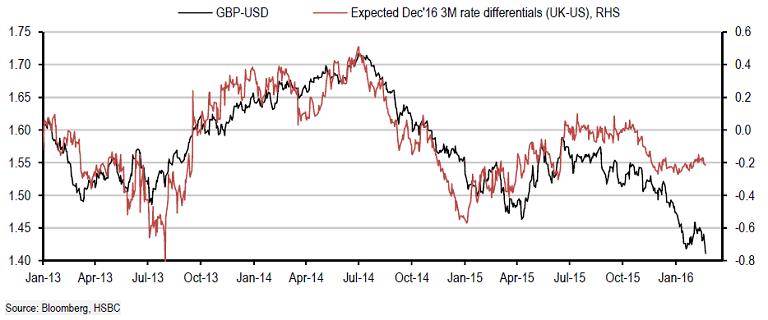

GBP-USD has closely followed US-UK interest rate differentials for most of the last three years, but this gap has opened up against a backdrop of opinion polls showing a 50:50 divide in voting intentions. This significant differential which has opened up along with political risk premium currently worth around 10%, suggests cable should be trading around 1.55, rather than the current 1.41.

"The currency market is also pricing a Brexit at around a 33% probability. So GBP-USD could fall by around another 15-20% should a Brexit become a reality - in other words if the probability shifted from 33% to 100%", notes HSBC in a research report.

GBP's vulnerability would not be limited to the knee-jerk political risk premium reaction to a Brexit vote. Future health of UK export growth would be at stake, not least for financial services exports. UK's current account and fiscal deficits are fragile, with a current account deficit already more than 4% of GDP, GBP can ill afford any additional widening. Brexit might also cause uncertainty over the likely scale of inward investment, which along with the fear a wider current account deficit, raises questions over its funding.

FX markets have been obsessed with the cyclical outlook and have largely ignored UK's structural shortcomings. Brexit would highlight UK's current account and fiscal deficits and place the currency under significant downward pressure. We would then see a complete shift from the cyclical to the structural. Uncertainty would also push the potential for BoE rate hikes much further into the future, and the dovish drift in UK rate expectations that has helped push GBP lower would extend further. The implied probability of a rate cut by the BoE is unchanged at around 35%. SG Economics still see a 45% chance of Brexit which could reduce UK and EU economic growth by as much 1% pa and 0.25% pa, respectively, for ten years.

"The combination of a higher political risk premium, a potential crisis of confidence about the UK's balance of payments, and a more dovish BoE would likely see GBP-USD falling 15-20% and down to levels not witnessed since the early 1980s", adds HSBC.

Cable steadied at 1.3949 after declining to a 7-year low of 1.3878 in the previous session, its lowest since early 2009. Against the yen, the pound was last at 156.47, having declined to 154.72 in the previous day, its lowest level since October 2013.

Market focus to shift from cyclical as Brexit highlights UK’s structural shortcomings

Thursday, February 25, 2016 9:27 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?