In usual scenario long rates almost never outrank short rates as a driver of EUR/USD, now they are doing so at present.

The longs will ultimately be unsustainable and short rates will need to take up the running in order for EUR/USD to keep moving higher.

Currency Options Roundup:

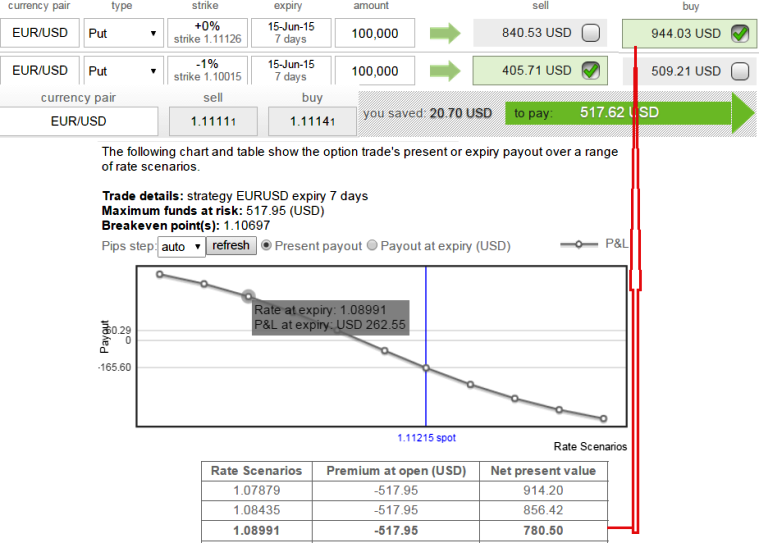

We suggest adding bearish EUR/USD exposure through puts or put spreads. Although the NPV of naked puts alarms quite costlier premiums other Greeks indicate safer zone to stay invested in. Risky traders can however prefer Naked puts.

But if you want to reduce the cost of hedging then put spreads can also be advocated as the premium collected on the Out of the money Put finances the naked put but it comes at the expense of partial hedge rather than a complete hedge.

Partial hedge strategy which only minimizes the loss if the underlying currency has to move lower but does not cap the loss.

Bear Put Spread shall be used over Protective Put if you think the premiums on Protective Puts are too costlier.

Bear Put Spread = Protective Put (strike at 1.1112) + Sell another Put with lower Strike Price (at 1.1001) (Out of the Money).

The above chart explains how this strategy considering in a scenario evidences the different profitability at different intervals of exchange rates.

NPV of naked puts costlier, Add Bear Put Spreads on EUR/USD

Monday, June 8, 2015 6:57 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary