Crude oil prices surged sharply after Trump pause tariff for 90 days. It hits a high of $63.31 yesterday and currently trading around $60.68.

EIA Report Reveals Increase in Crude Inventories Despite Declines in Gasoline and Distillate Stocks

U.S. crude inventory rose by 2.6 million barrels to 442.3 million barrels and Oklahoma Cushing inventory rose by 681,000 barrels, as per the April 4, 2025, EIA Weekly Petroleum Status Report. Gasoline inventory fell by 1.6 million barrels, and distillate inventory fell by 3.544 million barrels, lower than anticipated. The increase in crude inventories came due to greater imports and less exports, and U.S. average crude oil refinery inputs averaged 15.6 million per day. The total crude oil inventory is lower than the five-year average, and the drop in gasoline and distillate stock is a reflection of sustained demand for finished products.

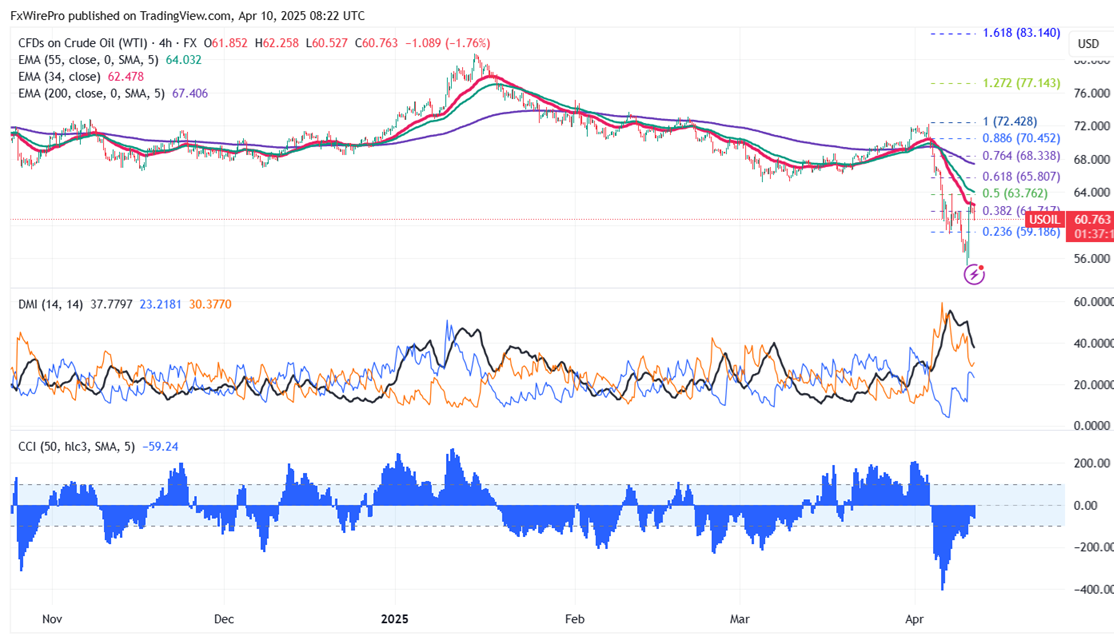

Price Resistance and Support Levels

The near-term resistance is around $63.50; any breach above this level could push prices higher to $$64.15/$65/$66. On the downside, immediate support is at $60 violation below targets $58.90/$58/$55.

It is good to sell on rallies around $61.95-62 with a stop-loss around $63.20 and a target price of $55

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand