We, at FxWirePro, have long been arguing in favor weakness in Chinese economy, debt bubble burst and we have also given some extreme calls, such as Yen to reach 98 per Dollar, EuroStxx50 to drop to 1500 level if China goes bust, which we are positive of to greater extent.

We also believe, Chinese currency Yuan likely to depreciate from here further and the decade long cycle of Yuan appreciation is over. We are however not alone in our call for further Yuan depreciation. Pessimists are plenty. While Yuan is currently trading at 6.56 per Dollar, Citi has called for Yuan 7.2 per Dollar in next 12 months, Bank of America Merrill Lynch (BofAML) 6.9 per Dollar by end 2016 and 6.7 per Dollar according to ING.

However, it is important to point out that we don't think or believe China is facing any currency crisis, Math just don't add up to such. The country's doesn't bear the criteria of any countries that has experienced currency crisis in the past.

- In spite of all weakness, China still delivers very large current account credit to the world.

- On an aggregate basis, in 2015 too, FDI inflows have been positive.

Only issue is capital account is running in quite large deficit, which is surpassing the above, however based on international investment position, China is still large creditor country. Official sector has register surplus, even during the years (2008-2013) of excessive leveraging.

So any weakness pertaining to foreign debt, is due to private sector but that is manageable.

According to BIS, as of 2nd quarter of 2015, non-bank US Dollar liability for China was $1.18 trillion, which has likely to have dropped as we write and even this figure is dwarfed by China's $3.33 trillion FX reserve.

We are however, concerned not over China's currency but debt. Dollar's share of non-financial corporate debt is just about 5%, so we are worried on that rest 95%, which as of Q2, 2015 was at $17.27 trillion and likely to have increased as we write.

Weakness in China's industrial and real estate sector means much of that loan has gone sour (not according to China's classification). According to China's official data, NPA is just about 1.4%. But we doubt that simply because China is one of world's innovative when it comes to hiding bad debt. Many a times, a soured debt gets refinanced over longer horizon or swapped by fresh equities.

All these practices are good for postponing the bust, keep production going and to keep employment high but they are not at all good for banks' profitability, unless they can create money out of thin air.

We, believe even that will be handled and PBoC will be supplying banks with Yuan liquidity and government will keep capitalizing the banks until good times are back again but that surely means more Yuan in the market and an inevitable declining in the value of Yuan.

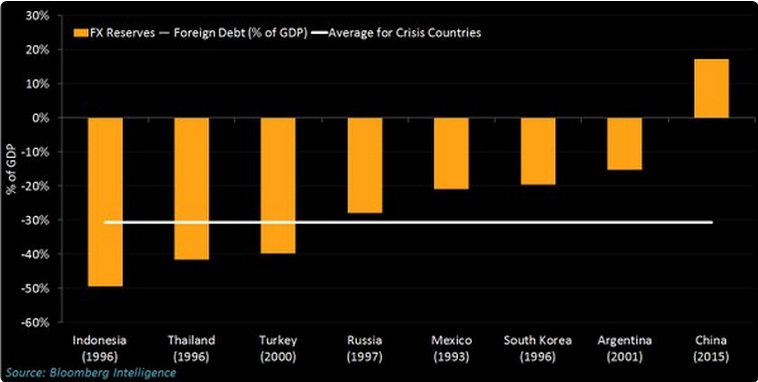

This fantastic figure from Bloomberg chief economist, Asia, Tom Orlik best explains why China not likely to face a currency crisis. FX reserve - foreign debt as a percentage of GDP has been negative 30% for countries that has suffered currency crisis in the past. For Indonesia, it was around -50% back in 1996. Compared to all that China's ratio stands at close to positive 20%.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX