China’s housing market has remained strong this year and has come as a surprise to many after the government’s explicit voicing of housing bubble concerns. China's home sales were up 26.4 percent y/y in the first seven months. Household loans and mortgage leverage have risen rapidly, fuelled by 250bp of mortgage rate cuts, recovering home sales and banks’ preference for quality assets.

Chinese household sector is relatively underleveraged compared with the government and corporate sector. Of China’s estimated 250 percent total debt-GDP ratio, just 40 percent is household debt while non-financial corporate sector debt stands at around 170 percent. Hence, stimulating the property market was the governments' natural policy response.

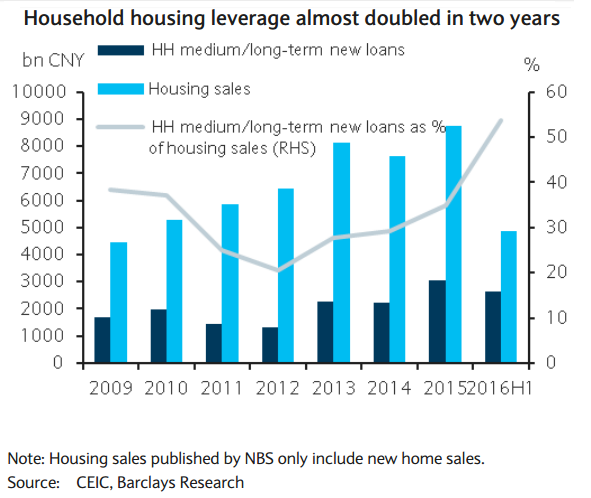

The buoyant housing market reflects a clear government intention to encourage the household sector to add leverage which potentially could help the corporate sector deleverage, as part of its strategy to address China’s massive debt build-up as well as to boost growth. Mortgage loans/home sales have risen from around 20 percent in 2012 to 37 percent in 2015 and 56 percent in H1 2016. Rapidly rising household leverage raises risks in the event of a housing correction.

"Surging leverage poses new risks in the event of a housing correction. Experience shows that housing busts preceded by large run-ups in gross household debt are associated with significantly deeper contractions in general economic activity," notes Barclays in a report.

China's real estate sector contributes 10-15 percent of the total GDP. Better home sales would help the developers reduce inventory and improve cash flows and profits. Moreover, a recovering housing market should boost investment and consumption growth and have a positive spillover effect for the upstream and downstream sectors.

But some analysts say slowing price growth and weakening property investment suggest the rebound may have peaked. Home price rises in China’s biggest cities showed signs of easing in July, adding to concerns that one of the economy’s key growth drivers is losing steam. Average new home prices in China’s 70 major cities rose 7.9 percent in July from a year earlier, an official survey showed, compared with a 7.3pc increase in June. But on a monthly basis, prices rose just 0.8pc in July, the same pace as in June.

"We believe the housing market is cooling down from the rebound in the first half. Property investment will continue to drop, which will put more pressure on the economy in the future,” said Nomura economist Wendy Chen.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary