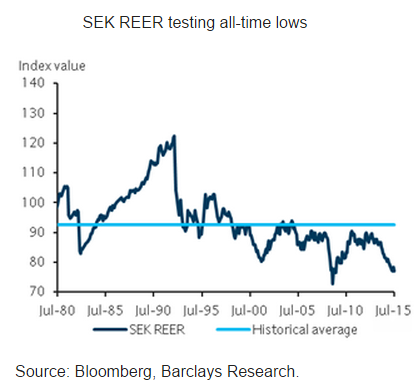

Inflation data in Sweden (Thursday) and Norway (Monday) will likely drive the price action for the Scandies in the coming week. Poor liquidity of Scandinavian currencies over the summer has contributed to modest EURSEK appreciation, significantly above recent range highs, and has caused the SEK REER to test its all-time lows. Extreme SEK undervaluation as temporary.

"We prefer to stay on the sidelines for now, respecting the recent price action and illiquidity. For the week ahead, we expect CPIF inflation to increase by 0.7% y/y (consensus: 0.6% y/y)," notes Barclays.

Market expectations are also for an unchanged CPI inflation print relative to June (0.3% m/m drop in CPI inflation corresponding to -0.4% y/y). Equally important, TNS Sifo Prospera will be publishing its monthly report on Swedish inflation expectations. In line with recent upticks, a modest rebound is expected in medium- and longer-term inflation expectations, which, in combination with the recent better-than-expected Swedish growth data and SEK weakness, should give some comfort to the Riksbank regarding the efficacy of its already hyper-accommodative policies.

In Norway, the recent decline in oil prices, weaker-than-expected domestic data, and a modest uptick in unemployment has increased market speculation about additional rate cuts by the Norges Bank. The baseline is still for no further easing, particularly given the recent NOK depreciation and increased financial stability considerations. However, the risks are skewed toward an additional rate cut in the remainder of 2015, particularly if the oil outlook deteriorates further, against the oil strategists' expectations.

On the inflation front, in line with the consensus, a slower pace in the increase of underlying price pressures (0.0% m/m, 2.6% y/y) is expected, attributing last month's upside surprise to residual pass-through from a weaker exchange rate. Although inflation will be important in the coming week, medium-term inflation expectations remain firmly anchored, implying that the Norges' policy debate still involves contemplating downside risks to growth from lower oil prices against increased financial stability considerations, likely exacerbated by additional rate cuts.

"We continue to think that EURNOK is close to its highs but expect only a modest reversal in Q4 from current levels," added Barclays.

SEK, NOK: Inflation data in focus

Monday, August 10, 2015 12:13 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022