After January's sudden move to remove 1.20 floor, it is difficult to rely on SNB to protect any Euro-Franc level.

However SNB intervened in the market today, as Euro was expected to tumble, which would have invariably pushed Euro-Franc towards parity.

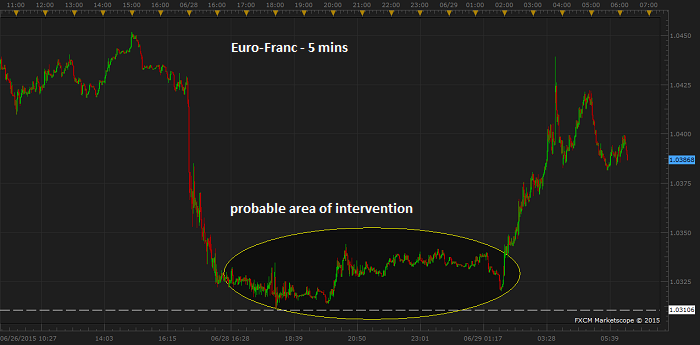

Talks suggest that SNB has intervened around 1.03 area, though details of the intervention wasn't declared by the bank. SNB intervention pushed Euro from around 1.03 area, after which it traded as high as 1.044 against Franc. Currently Euro is trading at 1.039 against Franc and 1.11 against dollar.

After months of sitting tight on Euro-Franc level, today's intervention seems SNB is likely to Keep Euro above parity.

Further intervention from SNB is expected as Greek uncertainty persists in the market.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand