Euro is on its way to close third consecutive weeks of positive gains against Franc, while Dollar is on its for fourth consecutive weeks and with special thanks to Swiss National Bank (SNB).

Price actions was somewhat foretelling this and today SNB declaration of FX reserve confirmed the move.

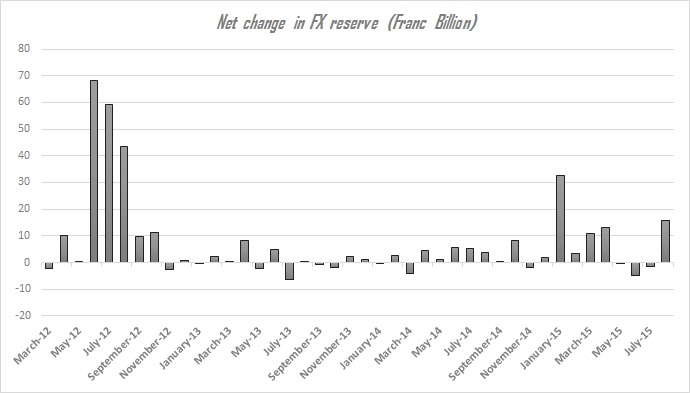

SNB is back at selling Franc with new vigor. The chart attached shows that FX reserve at SNB rose by 15.8 billion in July from June, highest pace since December, 2014. This change is fourth largest since 2012, at peak of Euro zone crisis.

Brief history:

- SNB had introduced a Peg of Euro and Franc at 1.2 in September, 2011 to avert heavy appreciation of Franc over Euro zone crisis.

- In summer of 2012, SNB had to use 171 billion in intervention, just over three months to defend the peg at peak of Euro zone crisis.

- Since then, SNB just had to use about 54 billion to defend the peg till December 2014.

- In December 2014, SNB had to use about 32.7 billion to defend the peg, as Euro dropped over speculation of quantitative easing from European Central Bank (ECB).

- July's selling has been the highest since then and fifth largest in at least three years.

There are possibilities of success for SNB in pushing Franc down, even against Euro.

Why?

- Euro zone crisis is long past and Europe is now moving towards growth.

- Initial knee jerk reaction to ECB's QE is majorly done with.

August moves are indicating that SNB is still large in the market, with Franc being the worst performing major this week.

Dollar might gain further against Franc if SNB maintains vigor.

Euro is currently trading at 1.076 against Franc, highest level since Fedruary. Further rise is possible, however 1.085-1.09 area is likely to pose as challenging resistance in the near term.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings