Swiss national Bank (SNB) failing its primary goal of price stability for many quarters now, putting serious doubts on SNB's credibility as well as ability to move inflation to the positive side.

Over and over SNB in official statement as well as in press conference iterated that it stands ready to act. But the question keeps on lingering, if not now, when?

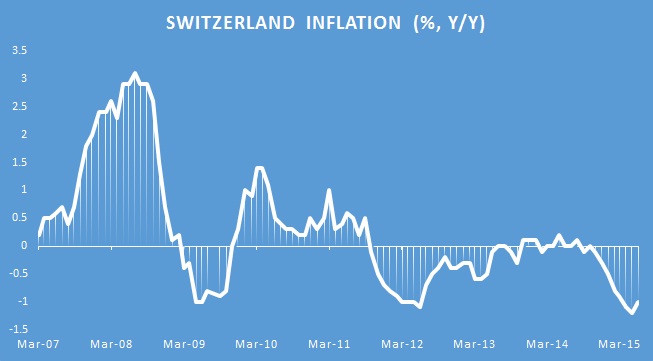

- Consumer price growth remains fragile at 0.1% m/m in June and it remains deep in deflationary territory (-1%), when looking at it on yearly basis.

Swiss disinflation/deflation have reached worst level surpassing 2008/09 crisis.

- After months of continued contraction, in June PMI showed Swiss manufacturing failed to grow in June compared to May.

Switzerland still enjoying high positive trade balance, however that might not hold for long if Euro remains low against Franc.

SNB sucking thumb -

SNB removed more than 3 yearlong Euro-Franc 1.20 floor on January 15th, which according to the official was pivotal to Swiss economy and tried to soothe the impact with further cutting interest rates to -0.75%.

Since then it has just sit tight except for occasional intervention in EUR/CHF rate. However, this chicken feed actions unlikely to bring back Swiss economy to reflationary path.

Without bold action to fight deflation, SNB is risking it to get deeply entrenched in consumers mind.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings