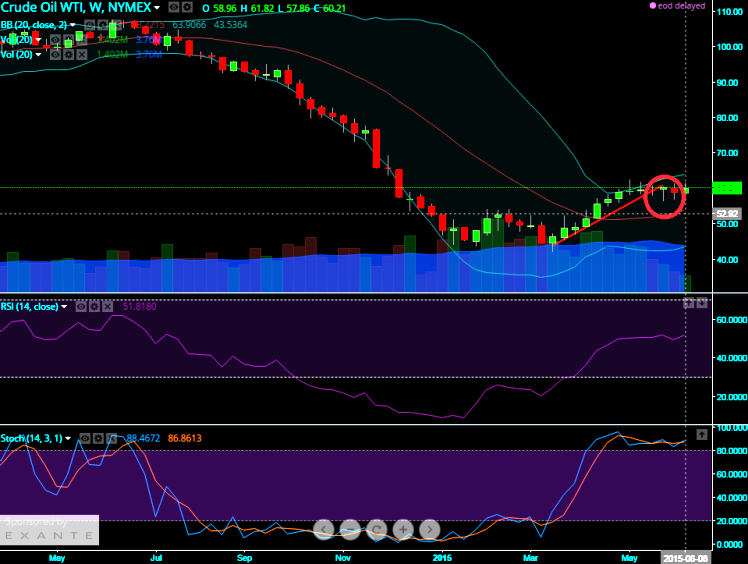

The recent price consolidation between 42.03 and 62.58 confirms our below standpoint, we note that prices are probing the upper end of the range.

When we plot charts of CL1 futures on weekly basis, it was spotted out the breach of trend line support at 60.41 levels & hanging man candlestick pattern at the same levels followed by the context of the spinning top pattern as well that formed early June.

Particularly, a daily close above or below 60.41 would determine the next stages for upcoming short terms rallies.

In addition, the topside resolution of the consolidation would cause us to adopt a bullish short-term (1-month) view for crude. But on the contrary hanging man below trend line followed by spinning top signifies drag below 60 levels are also kept in mind.

Oscillating indicators are not favoring the bulls of this commodity as the RSI (14) stagnantly converging with consolidation price patterns.

While slow stochastic trending above 80 levels already.

On a concluding note we don't think this commodity price dare to move beyond 56 towards south & 65 on north side range.

Keeping this in mind, short term trades are advised to short straddles in order to lock in premiums.

Short 5D At-The-Money WTI oil (strike at 60.10) with positive Theta.

Short straddles for range bounded WTI

Friday, June 12, 2015 11:57 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate