President Donald Trump signaled on Thursday that he is open to easing U.S. tariffs if other nations offer “something phenomenal,” hinting at possible trade negotiations. This came just a day after the White House introduced sweeping new tariffs on all imports, with harsher rates targeting countries labeled as “bad actors.”

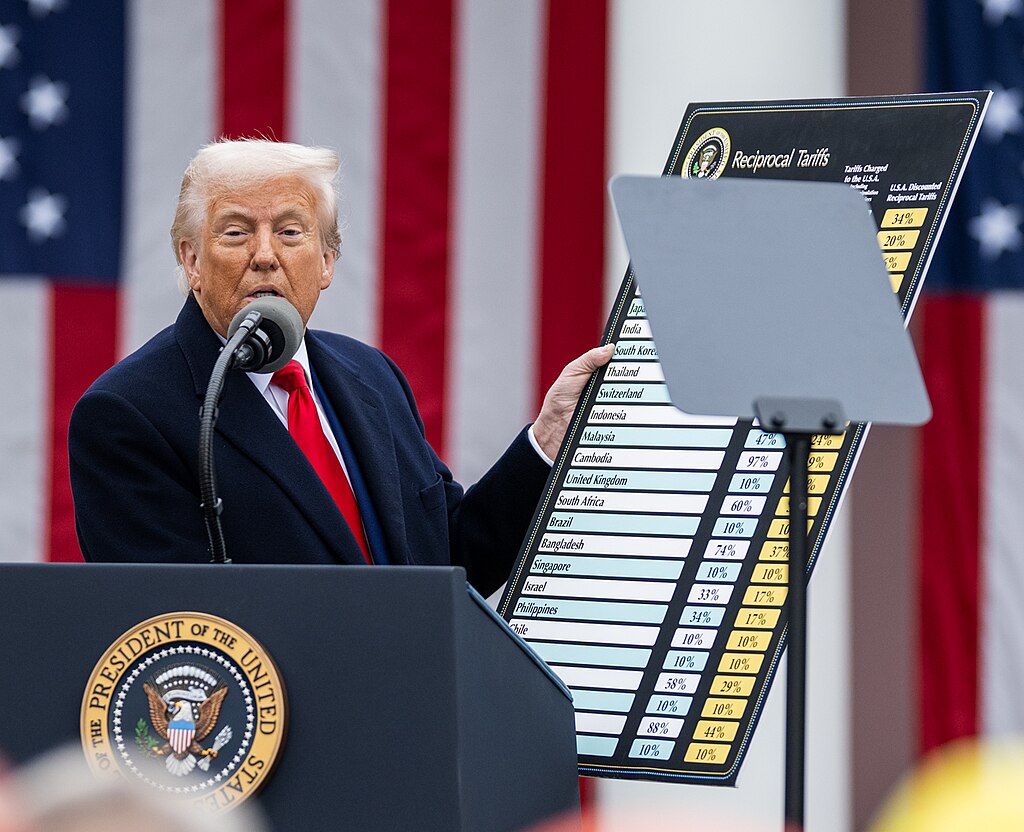

Under the new trade policy, the U.S. will apply a minimum 10% reciprocal tariff on all imported goods. Nations that impose higher tariffs on American products will face a matching response, with Trump stating some rates will be “half” of what those countries charge U.S. exporters.

China is expected to be among the hardest hit, facing a 34% new levy in addition to an existing 20% tariff—bringing the total to 54%. Beijing currently imposes a 67% tariff on U.S. imports. However, Trump extended a possible olive branch, indicating he could reduce tariffs on Chinese goods if China approves the sale of TikTok’s U.S. operations ahead of an April 5 deadline. The president noted that a deal is close, involving several American investors.

Financial markets reacted sharply to the tariff announcement. The S&P 500 and Nasdaq 100 both recorded their steepest single-day declines since 2020, driven by a sharp drop in tech stocks amid rising fears of demand destruction and a potential global trade slowdown.

Trump’s comments offer the first indication that his administration may be open to trade compromises, particularly with key partners like China. With the TikTok deal nearing completion, it could serve as a pivotal point in de-escalating trade tensions.

This development marks a crucial moment in U.S.-China trade relations and adds pressure on global markets already sensitive to geopolitical risks and tech sector volatility.

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links

Norway Opens Corruption Probe Into Former PM and Nobel Committee Chair Thorbjoern Jagland Over Epstein Links  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding