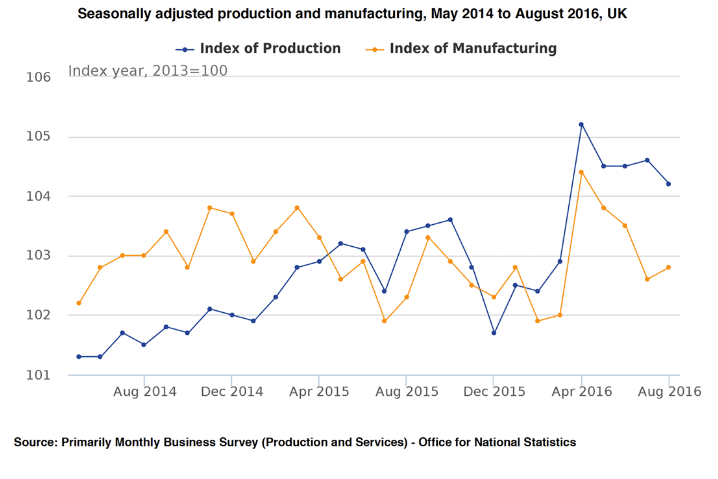

UK industrial production fell in August, breaking the recent run of upbeat economic news. Data from the Office for National Statistics released earlier today showed that UK industrial production unexpectedly declined in August. Industrial production fell 0.4 percent m/m, missing expectations of a 0.1 percent rise. On the year, it rose 0.7 percent, less than the 1.3 percent rise forecasted.

Details of the report showed manufacturing production was up 0.2 percent on the month compared to expectations of a 0.4 percent increase. It rose 0.5 percent on the year, missing expectations of a 0.8 percent gain. Manufacturing output has seen a cumulative 1.8 percent decline over the preceding three months and the small uptick in August only partly reversed the cumulative decline suggesting U.K. manufacturing still remains in the doldrums.

Today’s industrial production report is the first disappointing piece of “hard” data post-referendum. After witnessing a sharp 2.1 percent quarterly gain in Q2, the industrial sector looks set to drag on GDP growth in Q3. Today’s weak report was a reminder that UK’s post-referendum economic outlook is not overall unscathed. Analysts do not expect the Bank of England (BoE) to announce immediate policy easing on account of downbeat data, though they do not rule out a reduction in borrowing costs by the Monetary Policy Committee (MPC) by the end of the year.

"Following a strong start to the quarter, notably in the services sector, GDP growth for Q3 should still post a 0.4% q/q or so gain. But the weakness of today’s report is a reminder that solid early Q3 momentum does not imply that the UK’s post-referendum economic outlook is overall unscathed," said Lloyds Bank in a report.

Separate figures from the ONS showed that the UK's trade deficit widened in August. The UK's deficit on trade in goods and services came in at £4.7bn, compared to £2.2bn in July. The deficit on trade in goods alone widened by £2.6bn to £12.1bn. The widening deficit comes despite hopes that the weaker pound - which is currently trading at the lowest rate in more than three decades against the dollar - will boost demand for British goods.

"While these figures break the recent run of positive data for activity in the third quarter, the overall strength of recent data has probably lowered the chance of further monetary easing from the MPC. But committee members have previously warned against over-interpreting incoming data...so we still think that there is a decent chance that the bank rate will be cut to 0.10% in November," said Scott Bowman, UK economist at Capital Economics.

GBP/USD pair witnessed abrupt 6 percent flash crash in the early Asian morning, after markets reported of an erroneous ‘Fat finger’ trade. The major extends bearish pressure as markets head into U.S. non-farm payroll data. GBP/USD was trading at 1.2335, 2.22 pct lower on the day at around 12:15 GMT.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient