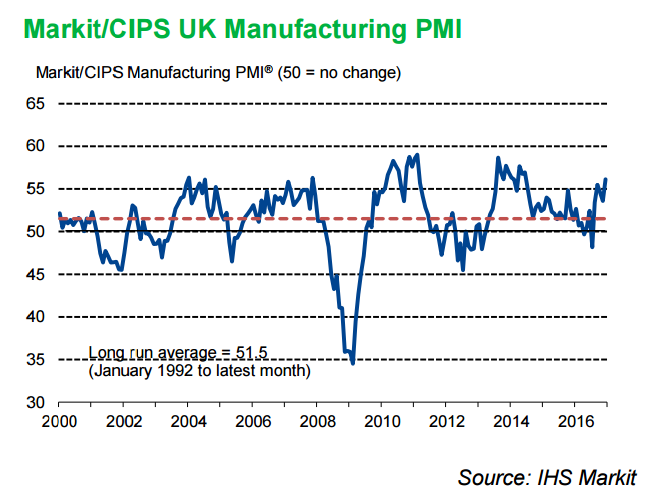

UK manufacturing sector smashed expectations for a decline with December manufacturing PMI unexpectedly rising to 30-month high. The seasonally adjusted Markit/CIPS Purchasing Managers’ Index (PMI) rose to 56.1 in December, up from 53.6 in November and well above its long-run average (51.5). Data exceeded all forecasts in a Reuters poll, which pointed to a decline to 53.1.

Improved domestic and overseas demand boosts output and new order growth. Competitiveness was boosted by a weak sterling which has undoubtedly been a key driver of the recent turnaround. Data showed new export business rose for the seventh successive month. Improved inflows of new business led to a slight increase in backlogs of work in December, the first rise since February 2014.

UK manufacturing is benefiting from both continued brisk growth in domestic demand as well as improving global demand. But analysts expect this momentum will likely peter out in 2017. Domestic demand for manufactured goods will crumble as consumers experience a renewed squeeze on their real incomes, driven mainly by higher import prices.

Also, boost to growth from sterling’s depreciation will remain relatively modest, because exporters have raised prices sharply and because uncertainty about the U.K.’s future trade relationships will deter exporters from investing. Data showed price pressures remained elevated in December. Rates of inflation for input costs and output charges both remained among the fastest seen on record.

"The manufacturing sector likely will struggle to maintain its current growth momentum throughout 2017," said Samuel Tombs, of Pantheon Macroeconomics.

The unexpectedly strong UK manufacturing data has propelled the pound to a two-week high against the euro on the first trading session of the new year. FTSE 100 broke the 7,200 mark, to hit an all-time record high of 7,205.21. The index pared some gains, dipped back below 7,200 after uptick in the pound. Cable surged from lows of 1.2246 to 1.23 levels after the data.

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at -47.8741(Neutral) and Hourly GBP Spot Index was at 23.7922 (Neutral) at 1100 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand