The key narrative in Josh Frydenberg’s 2021 budget was the need to use more aggressive fiscal policy to drive unemployment down and wages up.

Two key pieces of data this week indicate how things are tracking.

On Wednesday the Australian Bureau of Statistics published wages data. The Wage Price Index grew 0.6% for the March quarter, or 1.5% over the past year.

This is not a fast enough rate of wages growth to outstrip inflation by much, if at all, on a consistent basis. That’s a problem but not a surprise. The economy in general, and the labour market in particular, is still recovering from the COVID-19 pandemic.

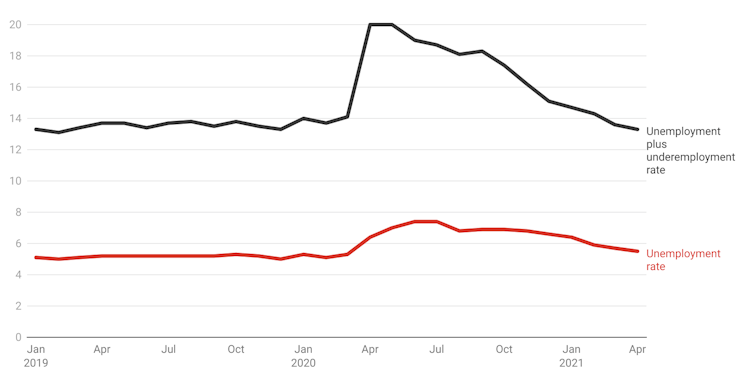

On Thursday the bureau published its labour force data for April. These were more of a surprise. The unemployment rate fell from 5.7% in March to 5.5%.

The unemployment rate had been hotly awaited by economists and politicians alike. It gave the first glimpse of what is happening with employment with the end of the JobKeeper wage-subsidy scheme in March.

A stunning unemployment result

The prevailing wisdom among economists was that JobKeeper’s end would see the unemployment rate rise. Treasury had warned it might cost 100,000 to 150,000 jobs. Australia’s leading labour economist, Jeff Borland, feared it could be as high as 250,000.

But as University of Melbourne economist Roger Wilkins pointed out, JobKeeper wasn’t the only labour-market program that changed at the end of March.

JobSeeker for singles dropped from $715 to $620 a fortnight (and from $660 to $565 for those with partners).

Moreover, income tests were tightened along with so-called “mutual obligation” provisions (requiring people on such benefits to apply for 20, rather than 15, jobs a month).

So the actual unemployment rate falling marginally rather than rising sharply could even be considered stunning.

Unemployment hits 5.5%, underemployment high

Per cent, seasonally adjusted. ABS Labour Force

The only real negative news in the April labour force data was that the total number of people employed fell by 30,600 – or 0.2%.

But as the ABS’ head of labour statistics, Bjorn Jarvis, said, this might be due to the end of JobKeeper or simply down to “the usual month-to-month variation in the labour market”.

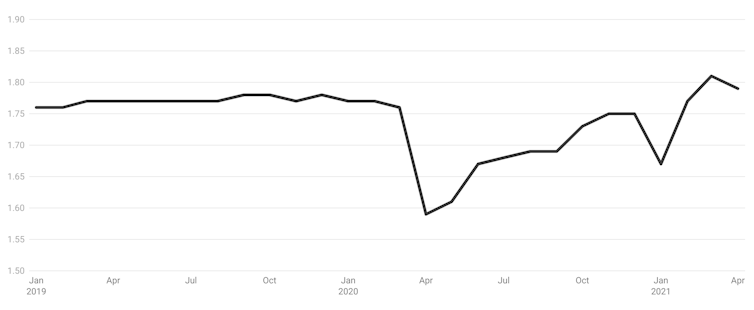

The same might be said of my favourite labour market statistic – total hours worked. That fell by 13 million hours in April, from 1.806 billion to 1.793 billion hours.

Total hours worked in all jobs

Billions per month. seasonally adjusted. ABS Labour Force

In sum, these figures are enough to make a treasurer want to dance. The single biggest threat to employment bouncing back from COVID-19 – the end of JobKeeper – seems to have been navigated without incident.

More to the point, this was exactly as Frydenberg said would be the case.

Maybe he got lucky, maybe he was just right all along, but it hardly matters.

The labour-market recovery in Australia marches on, and the significant spending in the budget means fiscal policy will not be a handbrake on continued recovery.

When will wages start to rise?

We shouldn’t get carried away. These new numbers reflect just one month without JobKeeper.

There are always time lags in the labour market. The statistics reported over the next two months will be important and instructive.

A 5.5% unemployment rate is still too high to lead to the tight labour-market conditions needed to drive up wages.

How low unemployment needs to get before wages start rising faster than inflation is still an open question.

It might be 4.5%, it might be 4%. Reserve Bank of Australia governor Philip Lowe has hinted it might well be below 4%.

What seems clear is it will need to be significantly lower than the pre-pandemic level of 5.2%.

Another note of caution is what happens if, as the Reserve Bank and Treasury have predicted, unemployment gets down low enough to put upward pressure on wages.

If this goes as planned it will be good news. If it leads to a general rise in inflation back to the central bank’s 2-3% target range, it will be excellent news.

But if inflation genuinely picks up in a sustained way – as there are hints it will do the United States – the RBA will eventually need to lift interest rates.

It is good for the central bank to have that policy option, but using it will come with costs.

If higher interest rates are need to dampen inflationary pressures in the next year – or even two – then the jobs recovery will be halted or reversed, and the RBA’s credibility severely damaged.

As Philip Lowe is fond of saying, “time will tell”.

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off