The SEK weakened sharply after the Riksbank’s dovish message at its October meeting which has raised questions whether the bank could refrain from cutting rates. On 26 October the Riksbank members unanimously held rates on hold. The minutes of the meeting released today showed that the Executive Board is concerned over the inflation outlook and that more easing measures are in the pipeline.

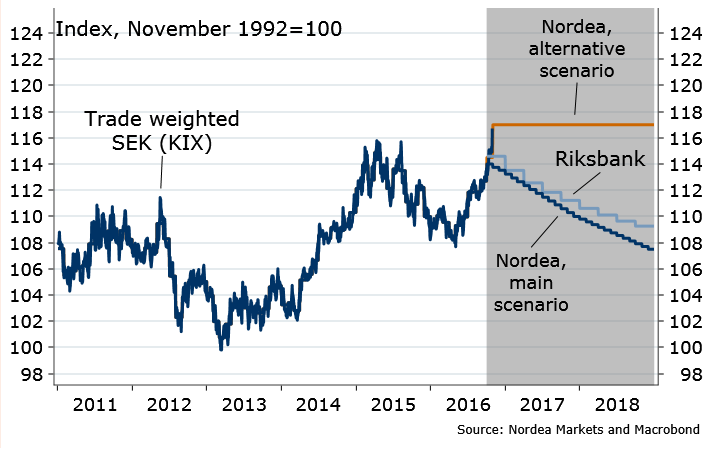

An SEK at current levels, with the trade-weighted exchange rate (KIX) at 117.5 and 2.5 percent weaker than the bank’s view, is not sufficient for the bank to step off the foot of the accelerator. With the weaker SEK, headline inflation is moving closer, but will nevertheless not reach the central bank's 2 percent target. Riksbank needs a weak SEK to boost inflation.

That said, there are probably also limits to how weak the SEK may go. Riksbank probably needs around 5 percent weakening per year for inflation to stabilise at or above 2 percent. This is neither likely nor desirable as the more the SEK ticks weaker, the greater will the future deflationary impulses be when the SEK starts to strengthen again.

But the SEK movements have been considerable during the past months, and the Riksbank will probably try to avoid too large swings in the exchange rate. The surprising Trump-victory has sent SEK lower against the US dollar. USD/SEK was 0.33 percent higher on the day, trading at 9.0131 at around 11:40 GMT. Trump-victory increases uncertainty on the economic outlook but does not change Riksbank outlook for more measures being in the pipeline.

"Our assessment is that things will develop in line with the Riksbank’s view. Consequently, we expect the Riksbank not only to extend the QE programme in December, but also cut the repo rate by 10bp to -0.60%," said Norges Bank in a report.

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings