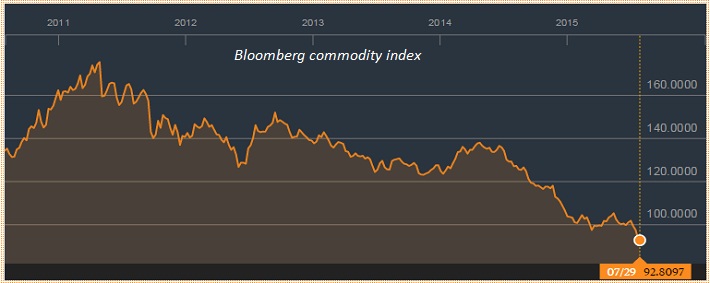

Commodities are hovering at multi year low, while some are hovering to multi-decade low. Traders, investors and hedge funds seems to be most bearish in the commodities.

We may not have reached the vantage point yet, but always helps to keep this in the back of the mind that a bull market begins when everyone is most bearish. This is also in line with contrary investment and trading theory.

Chinese slowdown is clearly posing headwinds for commodities and commodities boom of 2007/08 has led to lot of over capacity.

While these two factors are posing headwinds for commodities in general, at some point it is likely to reverse direction.

What factors to watch out for?

- Since supply has increased over the past few years, demand will have to improve significantly to provide support for commodities.

- Today's lower commodity prices have shelved billions of dollars' worth of new projects, capacity increase and expansion. This will be biting the market hard at some point in the future.

- Lower commodity prices, will help global economic recovery and it will also ensure increase of demand.

While the above factors would contribute to longer term sustainability of commodities, production cuts would show where the vantage point might be.

- Production cuts will be key indicator for turnaround in commodities. As of now some production cuts are taking place in industrial commodities segment, however that is clearly not sufficient as of now.

News of production cuts in Chile, largest producer in the world has hit newswire this morning. This may not be sufficient to end rout in copper but has the ability add some temporary floor to it. Copper is currently trading at $2.41/pound.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?