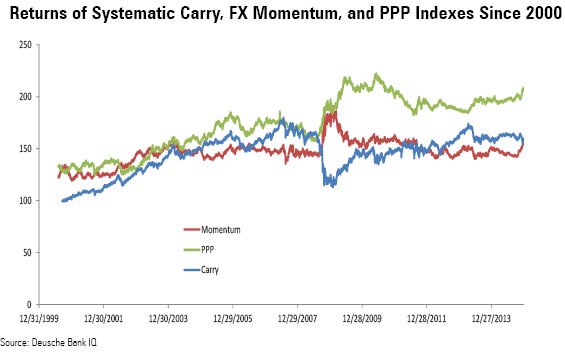

According to recent market activity, past performance of three top strategies are displayed in chart. Chart courtesy Deusche Bank.

Momentum -

- The momentum strategy after dismal performance during boom period of 2003 -2007 worked best during the final phase of boom and bust in 2008.

- The strategy has lagged since as volatilities were depressed across markets as central banks' provided quantitative easing.

- However, in recent times it started performing well indicating that there could be more volatile days ahead despite of asset purchase by ECB. Market moved in momentum across asset classes.

Carry -

- Carry trades performed well during 2000-2007 with high interest rates and falling dollar but was the worst performer during the 2008 crisis.

- Performance recovered after the crisis as volatilities remained depressed across board and some developing and emerging markets have kept the rates high.

- However, it started lagging in recent times with rise in volatility and drop in interest rate differentials. Does not look like the strategy to play during turbulent times.

Purchasing power parity (PPP) -

- Looks like fundamentals are still the best strategy to go with. The strategy worked very well even during financial crisis of 2008 and 2009.

- Performance somewhat waned aftermath of crisis; however the performance picked up as market started focusing on dollar fundamentals since 2011.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary