The EM strategies have turned underweight on Asia FX given a combination of higher core yields, the break out of USD/CNY to above 6.70 and multiple idiosyncratic issues.

The capital outflows from China had already picked up before expectations of a Fed hike and despite resilient data.

The additional dynamic of USD strength and expectations of a Fed hike in December suggests that risks to capital flight are skewed to the upside in Q4.

As a result, the expectation is for CNY weakening to accelerate in Q4, with spillover to the rest of the region as well.

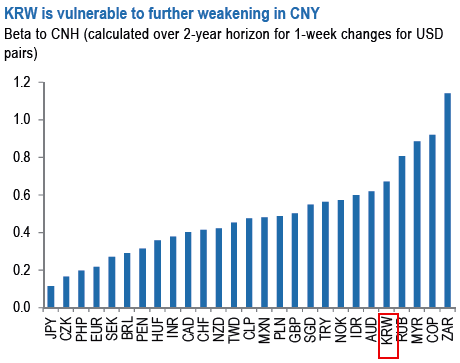

KRW is a notable candidate to short given that it has among the highest sensitivity in Asia to CNY weakness (see above chart).

In South Korea, the September exports drop inflated by temporary factors.

The consumer price inflation surprised on the upside.

The BoK left its base rate steady for the fourth straight month at the record low of 1.25 pct at its October meeting, as anticipated.

In addition, the added uncertainty on corporate earnings has the potential to slowdown equity inflows from offshore investors. So, long USDKRW are encouraged at 1135.43 via 3m NDFs.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate