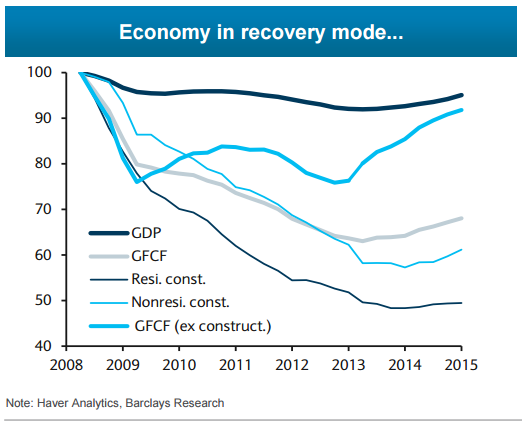

Spain's economic activity continued to beat most market expectations, with GDP growing 0.9% q/q in Q1, probably even accelerating further in Q2. As in other EA economies, growth is driven by private consumption (low inflation, better labour market), but private investment and public consumption also grew at a decent pace.

The outlook for H2 15 and 2016 remains strong, although some slowdown is likely: we expect GDP to grow by 3.3% this year and 2.7% next year as domestic demand slows, partly offset by a stronger contribution from net exports as key trading partners experience slightly better growth and market shares continue to improve. Improving financial and credit conditions will remain supportive of growth, facilitating lending dynamics and pushing non-performing loans further down. Nearly all relevant indicators are now signalling a recovery in the housing sector.

Barclays notes:

We estimate that in 2015 the cyclically adjusted fiscal balance will be slightly accommodative. The consolidated budget balance through April (excluding municipalities) has been reduced by 10.7% y/y: the deficit reached 1.05% of GDP versus 1.2% in April 2014. We see some downside risk to the deficit target of 4.2% of GDP, mainly related to the electoral cycle. Public expenditure was higher than expected in Q1 15, probably driven by the regional and municipal elections in May. We expect similar slippages on public expenditure in H2 15.

Moreover, the government has announced cuts to the personal income tax rate, applicable in July 2015 and worth EUR1.5bn. Overall, we do not think the extent of fiscal slippage this year will be large (less than 0.5%), mainly because strong growth is compensating somewhat, but a tighter fiscal stance will be needed in 2016 to meet the government's medium-term fiscal targets and debt-reduction objectives.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022