Today UK GDP preliminary reading showed UK economy is on its way to another block buster pace of growth in second quarter. GDP increased by 0.7% in the second quarter of 2015. GDP is expected to grow at 2.6% in the second quarter from a year ago.

GDP grew by 0.4% in first quarter.

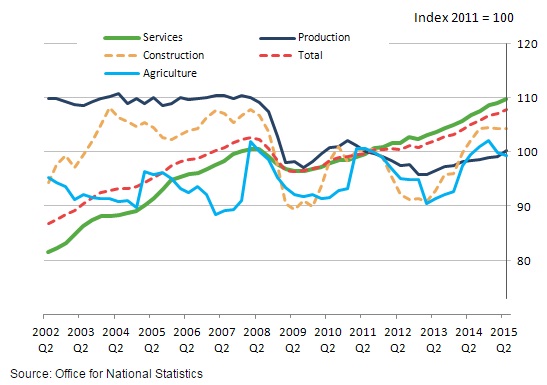

However notably, this block buster economy has its strength too concentrated on services sector. The largest contribution to the increase came from the services sector, contributing 0.5 percentage points to second quarter.

Problem with UK's growth is that though overall pace and services sector surpassed peak before 2008 great recession, manufacturing and construction activity still after six years remain well below their pre-crisis peak.

With Bank of England ready to reverse its crisis easing, it won't be easier for these two rate sensitive sectors.

And Britain's crown jewel service sector is facing a grave risk.

UK Prime Minister has proposed a referendum by 2017 over its stay within EU, if the government fails to negotiate some pre-conditions, which will protect Britain, moreover London from EU rules and taxations and in turn will benefit UK's services sector mainly financials.

IF Prime Minister Mr. Cameron's government fails to negotiate UK's demand, which might require a treaty change in EU and people of Britain still vote to stay in EU, services sector will be single biggest loser.

In the short term GDP boosted pound, which now stands as the best performer today so far, trading at 1.561 against dollar.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?