Humans have made drastic changes to the environment. We need to change our behaviour – and we need to do it fast.

One simple way you can do your part is by investing your money responsibly. Sustainable investing has emerged as a way to make a positive impact on the planet and society while also achieving your financial goals – and it’s popularity is really starting to grow.

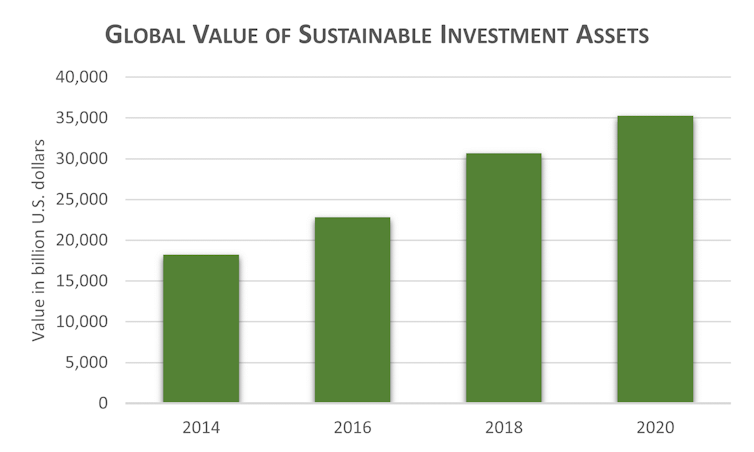

At the beginning of 2020, the global value of sustainable investment in major financial markets stood at US$35.3 trillion (£27.7 trillion). That’s equal to approximately one-third of the value of all the listed companies throughout the world in 2020, and almost 364 times the amount spent globally on space programmes in 2022.

But what makes an investment worthy of the “sustainable” title? And what should you consider when researching sustainable investments of your own?

Sustainable investing has been increasing in value for almost a decade. Statista (2023), CC BY-NC-SA

Identifying a sustainable investment

Sustainable investing is an investment approach that considers environmental, social and governance (ESG) criteria in addition to traditional financial factors. Environmental criteria might include factors like a company’s carbon footprint, resource use and energy efficiency. Social factors assess how a company handles its relationships with people, and governance factors examine the behaviour of the company’s leadership.

Sustainable and ethical investing are sometimes used interchangeably. But it’s important you understand the distinction between them. Sustainable investing tends to focus more closely on ESG factors overall and how they are being applied within an organisation. Ethical investing instead considers the moral, belief and value factors of an organisation and how they align with your principles.

The best place to start researching the sustainability of an investment would be to analyse either the annual report of an individual company or the fact sheet of a collective fund. Review the ESG practices of the organisation. Has the company complied with all required standards? And how do their results benchmark to competitors in the same industry?

Don’t forget to investigate the companies on various investment and finance sites, as many have detailed information for listed companies. Or check out the stock exchange sites themselves.

Companies listed on the London Stock Exchange, for example, may have received the “Green Economy Mark”. This recognises companies and funds that derive more than half of their revenues from products and services that are contributing to environmental objectives, such as tackling climate change or reducing waste and pollution.

The Nasdaq, an American stock exchange based in New York City, has the Green Equity Indexes. The Indexes are comprised of companies that are working to enhance economic development based on a reduction of carbon usage.

And the New York Stock Exchange has a new asset class of companies called Natural Asset Companies. These are companies that hold rights to the preservation and conservation of natural assets like trees and green spaces, so allow you to invest directly in environmental protection.

Investing in natural asset companies allows investors to play their part in environmental protection. Smileus/Shutterstock

Is it profitable?

Just because an investment is good for the environment doesn’t mean it won’t make money. To check whether it’s likely to be profitable, you can look at how well the company is doing financially and analyse predictions for its growth and future plans.

You should consider its position in the market and any unique characteristics it has, while also checking whether the company’s leadership own a significant amount of shares. If they do, then this demonstrates they believe in their company’s success and “have skin in the game”. Check if the company pays out a dividend too, and remember to evaluate its planning for potential risks that could harm its reputation.

If you are looking to invest with a focus more on making a positive impact over profitability, then consider companies that lack capital due to existing in less mature or niche markets. You could invest in “small-caps”, which are generally up-and-coming companies with potential for large growth, or screen companies based on the types and costs of their sustainability practices.

Smaller companies can be less profitable compared to their larger counterparts. But their potential for positive impact may be greater. This is because, among other things, small companies may be more likely to take into account the full life-cycle of their product.

Minding your money

It is paramount for you to clarify your own values and goals before deciding where you invest your money. This will help to determine if your interests align with the company’s ESG operations, performance and long-term strategies.

Sustainable investing can take several forms. You could decide to adopt “positive screening” where you actively seek out investments that match your values. Or you could avoid any investments in an area that you disagree with – a strategy called “negative screening”.

You should also undertake further research to ensure that the company has actually been carrying out its reported ESG activities and has not been accused of greenwashing. Anti-greenwashing rules have recently been introduced banning UK asset managers from using vague references to “sustainability” in marketing their funds. Prior to this, companies applied this label with little oversight from regulators.

Until recently, UK asset managers have been using vague references to Ivan Marc/Shutterstock

When it comes to the investing process, you could be scammed if you don’t conduct due diligence that the platform you are using is trustworthy and has the relevant credentials. You may also wish to consider an independent financial advisor for bespoke professional advice, especially if you have little investing experience.

Investments can go both up and down. It’s your responsibility to undertake thorough research before making an investment decision and putting capital at risk. Don’t invest money you can’t afford to lose.

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth

ADB: Short Strait of Hormuz Closure Would Have Limited Impact on Developing Asia Growth  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions

Asian Stocks Rebound as KOSPI Surges, China Signals Stimulus Amid Global Tensions  U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns

U.S. Stocks Rise as Strong Economic Data Offsets Middle East Conflict Concerns  Investors value green labels — but not always for the right reasons

Investors value green labels — but not always for the right reasons  Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War

Insignia Financial Shares Hit 3-Year High Amid Bain and CC Capital Bidding War  Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns

Apple Downgraded by Jefferies Amid Weak iPhone Sales and AI Concerns  Do investment tax breaks work? A new study finds the evidence is ‘mixed at best’

Do investment tax breaks work? A new study finds the evidence is ‘mixed at best’  UK Markets Face Rising Volatility as Hedge Funds Target Pound and Gilts

UK Markets Face Rising Volatility as Hedge Funds Target Pound and Gilts  Home ownership is slipping out of reach. It’s time to rethink our fear of ‘forever renting’

Home ownership is slipping out of reach. It’s time to rethink our fear of ‘forever renting’  SoftBank Eyes Up to $25B OpenAI Investment Amid AI Boom

SoftBank Eyes Up to $25B OpenAI Investment Amid AI Boom  China Aims to Maintain Stable Employment Amid AI Growth and Labor Market Challenges

China Aims to Maintain Stable Employment Amid AI Growth and Labor Market Challenges  China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security

China Unveils New Five-Year Plan Focused on Tech Power, Economic Growth, and National Security  Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply

Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears