ASML has become Europe’s most valuable company by dominating one of the most critical technologies in modern chipmaking: extreme ultraviolet (EUV) lithography. These massive semiconductor lithography machines, often described as “chip printers,” cost up to $250 million each and are essential for producing the world’s most advanced chips used in artificial intelligence, high-performance computing, and data centers.

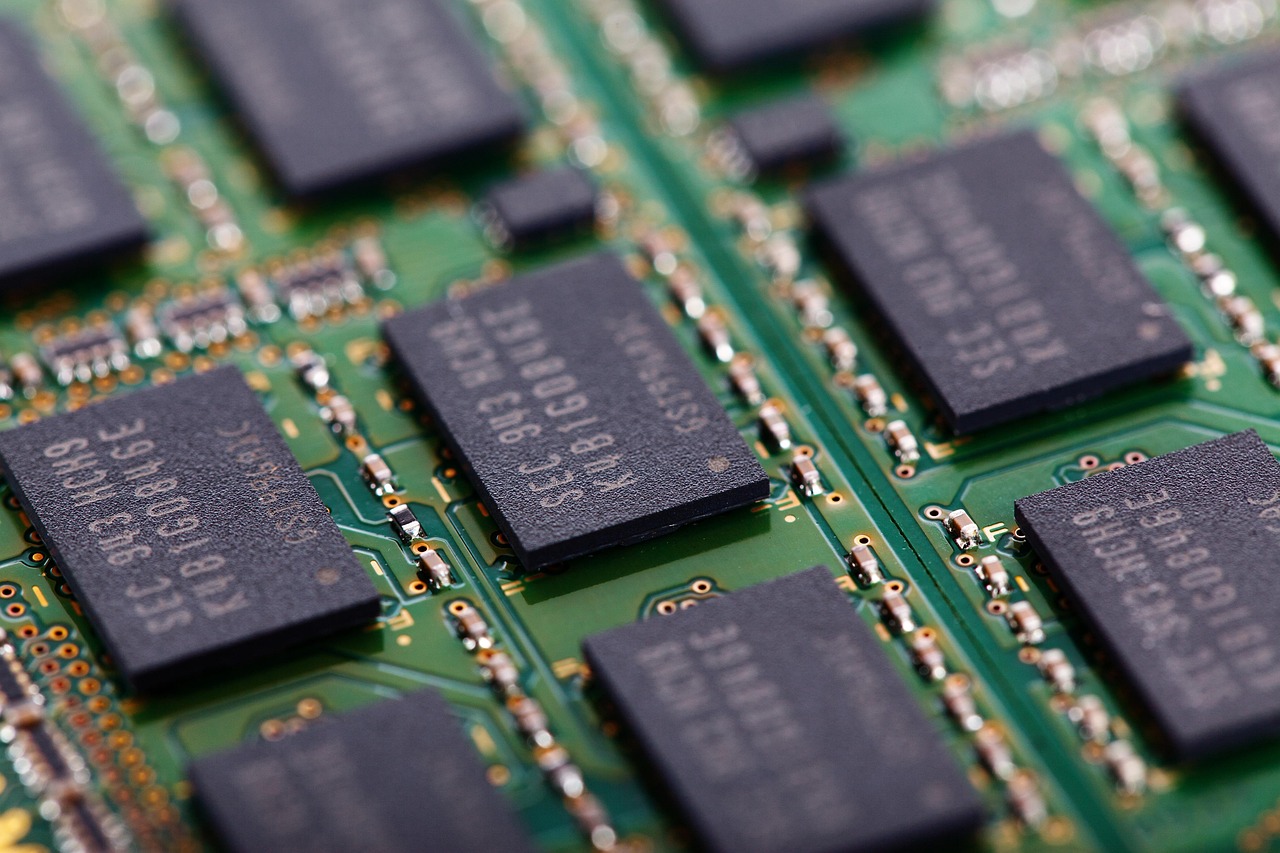

The surge in demand for ASML’s EUV systems is being driven by rapid advances in AI and the global expansion of data center infrastructure. Leading semiconductor manufacturers such as TSMC, Samsung, Intel, SK Hynix, Micron, and Rapidus rely on ASML’s technology to manufacture cutting-edge AI chips, including those designed for Nvidia. ASML currently holds a monopoly on EUV lithography machines, giving it a unique and powerful position in the global semiconductor supply chain, even as competitors in the U.S. and China attempt to develop alternatives.

ASML’s EUV machines are engineering marvels. Each system is roughly the size of a school bus and weighs around 150 tons, yet it operates at the nanometer scale. The machines project intricate circuit patterns onto silicon wafers using EUV light with a wavelength of just 13 nanometers. To put that into perspective, a single human hair is about 80,000 to 100,000 nanometers thick. This extreme precision enables higher chip performance, better energy efficiency, and greater scalability—key requirements for advanced AI processors.

Producing EUV light is one of the most complex processes in modern manufacturing. Tiny droplets of molten tin are fired 50,000 times per second and hit with some of the most powerful industrial lasers ever built, supplied by Germany’s Trumpf. The resulting light is directed by ultra-smooth mirrors from Zeiss, kept in a vacuum and polished to standards exceeding those of space telescopes. Meanwhile, the wafer stage levitates on magnetic fields and moves at speeds of up to 80 meters per second with astonishing accuracy.

Once assembled in the Netherlands, each EUV system is shipped in about 40 containers and flown by cargo aircraft to chipmaking facilities worldwide. In 2024 alone, ASML delivered 44 EUV machines, with analysts forecasting significantly higher shipments in 2026 and 2027 as global demand for AI chips continues to rise.

Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge