ASML has become Europe’s most valuable company by dominating one of the most critical technologies in modern chipmaking: extreme ultraviolet (EUV) lithography. These massive semiconductor lithography machines, often described as “chip printers,” cost up to $250 million each and are essential for producing the world’s most advanced chips used in artificial intelligence, high-performance computing, and data centers.

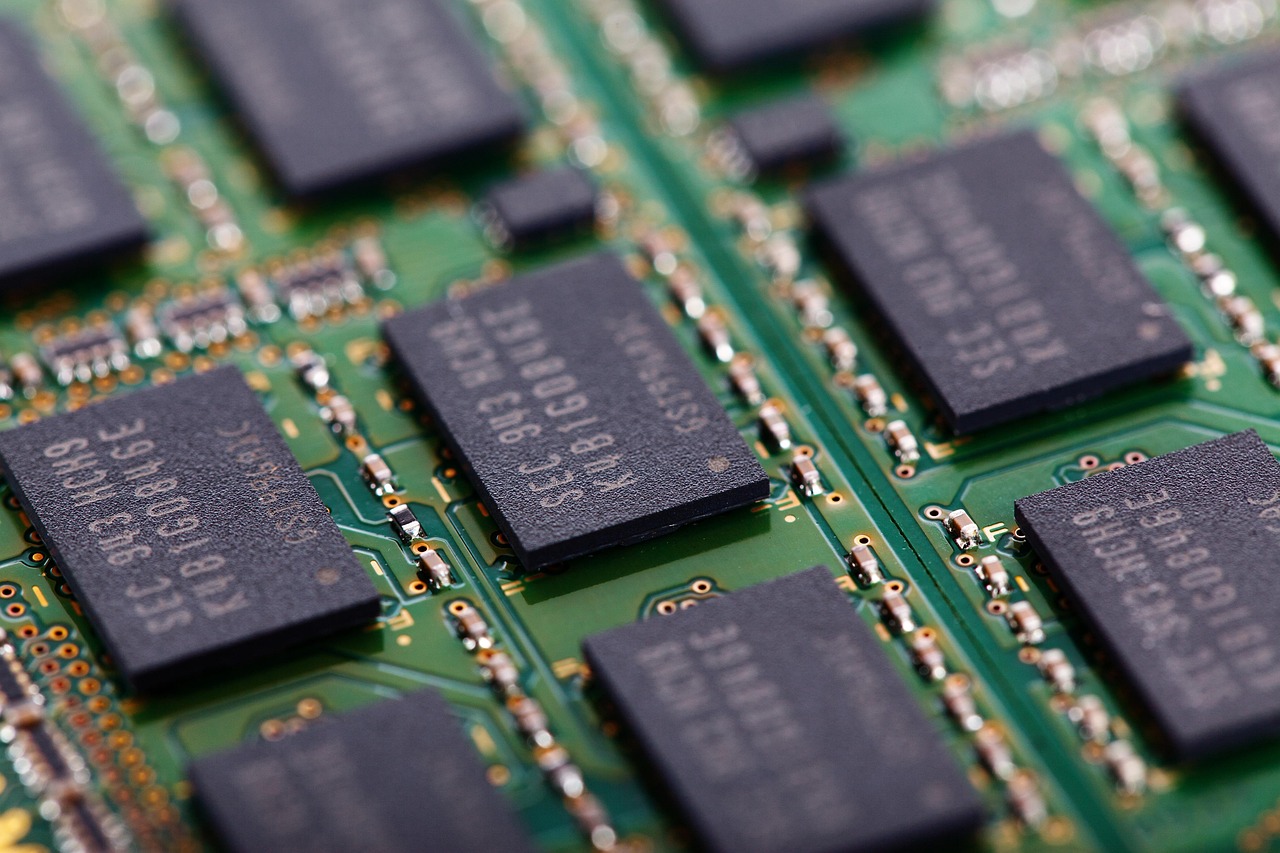

The surge in demand for ASML’s EUV systems is being driven by rapid advances in AI and the global expansion of data center infrastructure. Leading semiconductor manufacturers such as TSMC, Samsung, Intel, SK Hynix, Micron, and Rapidus rely on ASML’s technology to manufacture cutting-edge AI chips, including those designed for Nvidia. ASML currently holds a monopoly on EUV lithography machines, giving it a unique and powerful position in the global semiconductor supply chain, even as competitors in the U.S. and China attempt to develop alternatives.

ASML’s EUV machines are engineering marvels. Each system is roughly the size of a school bus and weighs around 150 tons, yet it operates at the nanometer scale. The machines project intricate circuit patterns onto silicon wafers using EUV light with a wavelength of just 13 nanometers. To put that into perspective, a single human hair is about 80,000 to 100,000 nanometers thick. This extreme precision enables higher chip performance, better energy efficiency, and greater scalability—key requirements for advanced AI processors.

Producing EUV light is one of the most complex processes in modern manufacturing. Tiny droplets of molten tin are fired 50,000 times per second and hit with some of the most powerful industrial lasers ever built, supplied by Germany’s Trumpf. The resulting light is directed by ultra-smooth mirrors from Zeiss, kept in a vacuum and polished to standards exceeding those of space telescopes. Meanwhile, the wafer stage levitates on magnetic fields and moves at speeds of up to 80 meters per second with astonishing accuracy.

Once assembled in the Netherlands, each EUV system is shipped in about 40 containers and flown by cargo aircraft to chipmaking facilities worldwide. In 2024 alone, ASML delivered 44 EUV machines, with analysts forecasting significantly higher shipments in 2026 and 2027 as global demand for AI chips continues to rise.

Costco Faces Class Action Lawsuit Over Tariff Refunds as Supreme Court Strikes Down Trump's IEEPA Tariffs

Costco Faces Class Action Lawsuit Over Tariff Refunds as Supreme Court Strikes Down Trump's IEEPA Tariffs  Trump Administration Proposes Tough AI Contract Rules as Anthropic Blacklisted by Pentagon

Trump Administration Proposes Tough AI Contract Rules as Anthropic Blacklisted by Pentagon  Big Tech Turns to Debt Markets to Fund AI Infrastructure Boom

Big Tech Turns to Debt Markets to Fund AI Infrastructure Boom  Domino's Pizza UK Reports 15% Drop in Annual Profit Amid Weak Sales and Rising Costs

Domino's Pizza UK Reports 15% Drop in Annual Profit Amid Weak Sales and Rising Costs  Oracle Stock Surges as AI Data Center Boom Drives Revenue Beat and Bullish 2027 Outlook

Oracle Stock Surges as AI Data Center Boom Drives Revenue Beat and Bullish 2027 Outlook  Amazon Website Outage Disrupts Thousands of U.S. Shoppers Before Services Recover

Amazon Website Outage Disrupts Thousands of U.S. Shoppers Before Services Recover  Robinhood Banking Surpasses $1 Billion in Deposits Following Successful Relaunch

Robinhood Banking Surpasses $1 Billion in Deposits Following Successful Relaunch  Morgan Stanley Limits Withdrawals at Private Credit Fund Amid Market Turmoil

Morgan Stanley Limits Withdrawals at Private Credit Fund Amid Market Turmoil  Lockheed Martin Invests $150M in Alabama Missile Production Facility

Lockheed Martin Invests $150M in Alabama Missile Production Facility  Joby Aviation Reaches Major Milestone in FAA Certification for Electric Air Taxi

Joby Aviation Reaches Major Milestone in FAA Certification for Electric Air Taxi  PayPay IPO Expected to Price at Lower End Amid Global Market Uncertainty

PayPay IPO Expected to Price at Lower End Amid Global Market Uncertainty  UK Regulators Demand Social Media Platforms Strengthen Children's Age Verification

UK Regulators Demand Social Media Platforms Strengthen Children's Age Verification  Broadcom Stock Jumps After Strong Earnings Beat and Bullish AI Revenue Outlook

Broadcom Stock Jumps After Strong Earnings Beat and Bullish AI Revenue Outlook  Yann LeCun's AI Startup AMI Raises $1 Billion at $3.5 Billion Valuation

Yann LeCun's AI Startup AMI Raises $1 Billion at $3.5 Billion Valuation  SoftBank Seeks Up to $40 Billion Loan to Fund Major Investment in OpenAI

SoftBank Seeks Up to $40 Billion Loan to Fund Major Investment in OpenAI  Chinese AI Stocks Surge as Tencent, MiniMax, and Zhipu Launch Agentic AI Programs

Chinese AI Stocks Surge as Tencent, MiniMax, and Zhipu Launch Agentic AI Programs  Microsoft Backs Anthropic in Legal Fight Against Pentagon's AI Blacklist

Microsoft Backs Anthropic in Legal Fight Against Pentagon's AI Blacklist