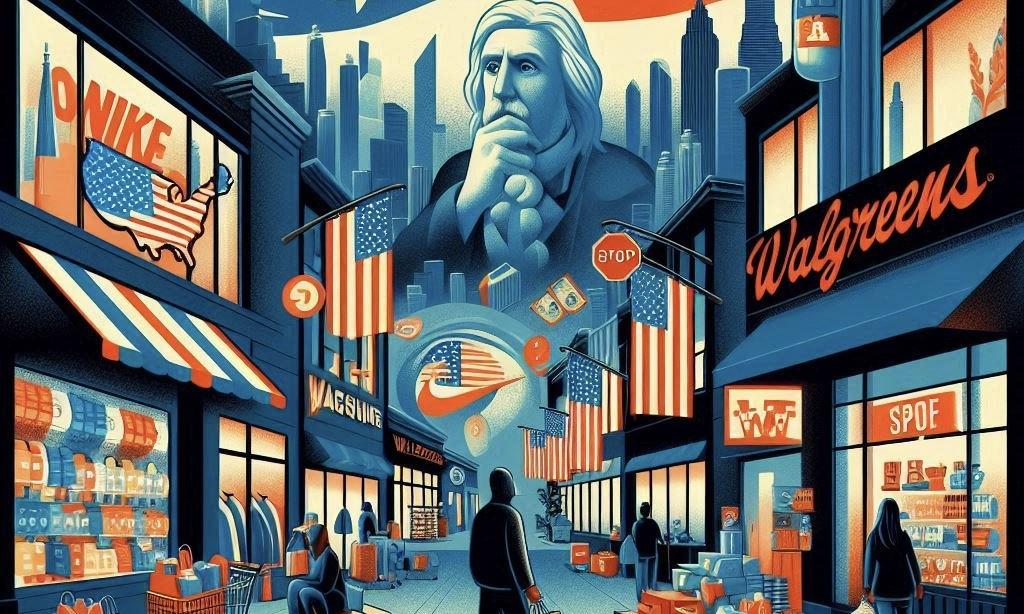

Americans' spending patterns are flashing a warning of a possible consumer-led recession. People aren't spending like they used to, forcing companies like Nike and Walgreens to make drastic changes.

US Consumers Shift Spending to Experiences as Rising Prices Impact Household Budgets and Retail Sales

This summer, consumers in the United States are caught in an unusual situation.

According to Business Insider, people continue spending money; however, there is an uncomfortable realization that each dollar's value has diminished due to years of price increases.

In the past year, US consumers have been reducing their purchases of physical products while still investing in experiences such as travel and dining.

Even though prices have slowed mainly from their pandemic-era increases, they are still up by approximately 20% from 2020 and are unlikely to decrease.

This is significantly impacting household budgets.

According to Bloomberg, Joseph Lewis, 33, has been exploring methods to safeguard the financial cushion his family accumulated in 2021.

"We're in a space where we have to be financially creative in terms of really figuring out what it is you can do without and even what it is that you can perhaps do on your own," Lewis said.

Presently, retail brands are experiencing the consequences of this gradual downward trend. Nike and Walgreens reported earnings this week that were hindered by declining sales.

Economic Experts Warn of Consumer-Led Recession as US Spending Patterns Show Signs of Weakness

According to economic experts (via Yahoo Finance), the stimulus-fueled purchasing spree in the United States is nearing its conclusion, and the decrease in spending may indicate the impending onset of a consumer-led recession.

After a prolonged period of robust spending that has sustained economic growth over the past few years, consumers are now beginning to reduce their spending patterns, which could impact the economy. According to United States Census Bureau data, retail expenditure increased by 0.1% in May, but sales volume decreased by 1.3% year-over-year in the past three months.

According to economist David Rosenberg, this represents a substantial indication that the long-awaited consumer recession is imminent, as it contributes to a 4% decrease in retail sales during the first quarter.

"The weakness in the consumer can now be considered a 'trend' ... "The 'build in' for Q2 real retail sales is now negative, coming on the heels of a -4.4% annualized decline in Q1," he said in a note to clients this week. "Early signs of a consumer recession finally coming to the fore."

The cumulative effects of inflation and a cooling employment market make shoppers less inclined to open their wallets.

According to a recent survey conducted by McKinsey, consumer sentiment has deteriorated due to the sluggish recruiting activity and the increased cost of living. The consulting firm's survey revealed that 55% of respondents had "mixed" or "pessimistic" sentiments regarding the economy in the second quarter.

"In general, consumer attitudes remain depressed relative to pre-pandemic — likely a function of lingering angst over inflation and interest rates," Deutsche Bank strategists said in a recent note. "Though the labor market appears strong on the surface, consumers' confidence around the labor outlook has begun to slip and suggests a potential pick up in the unemployment rate."

Consumers' financial situation, particularly those in lower—to middle-income households, is also worse than it was last year. According to Federal Reserve data, the delinquency rate on credit card loans has reached its most significant point in 13 years.

Meanwhile, the McKinsey survey revealed that 76% of consumers reported engaging in a "trade-down" in the first quarter, which involved transferring to a less expensive brand or looking for lower prices.

Photo: Microsoft Bing

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast

Palantir Stock Jumps After Strong Q4 Earnings Beat and Upbeat 2026 Revenue Forecast  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report

Sam Altman Reaffirms OpenAI’s Long-Term Commitment to NVIDIA Amid Chip Report  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz

SpaceX Reports $8 Billion Profit as IPO Plans and Starlink Growth Fuel Valuation Buzz  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised