The unemployment rate is sufficient to demonstrate the calculated case to long NOK. The jobless data is exactly the same as it was at 2.7% when Brent was at the peak $115 last summer.

So one could be thinking by now what has that factor got to do with the new oil market realities, even if a lagged rise in unemployment is to be expected.

This is not to deny that a halving of the oil price will have a material effect on the economy, of course it will, it's just that the magnitude of the downturn is proving less intense than many, including the Norges Bank, believed (1Q GDP growth was reported this week at 2.0% saar).

The currency shake-off is likely event if an economy is associated with global oil trade terms. The psychological oil-slick means that NOK is the cheapest G10 currency whereas GBP is virtually the most expensive, in other words these are good entry levels for a tactical trade that exploits a potential rebound in oil prices over July and August.

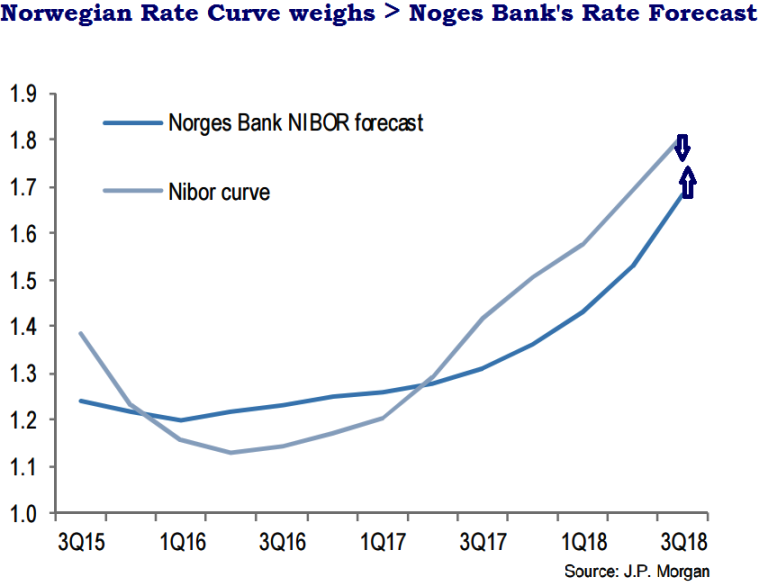

The Norwegian rate curve prices more cuts through 201 than the Norges bank's path which limits downside for NOK.

As shown in the diagram, Norges Bank rate cut on June 18th may depress NOK since the NOK rate curve is already priced in for marginally more easing than the central bank's projections.

Ahead of the rate decision, the preliminary energy sector capex survey for 2016 is scheduled on June 12.

This will have a potential bearing on the Norges Bank's longer-dated rate guidance to the extent that it shows the slide in capex continuing into 2016 or starting to wind down.

Any hike in oil prices impacts adversely on sterling; monetary policy on NOK

Wednesday, June 3, 2015 12:33 PM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary