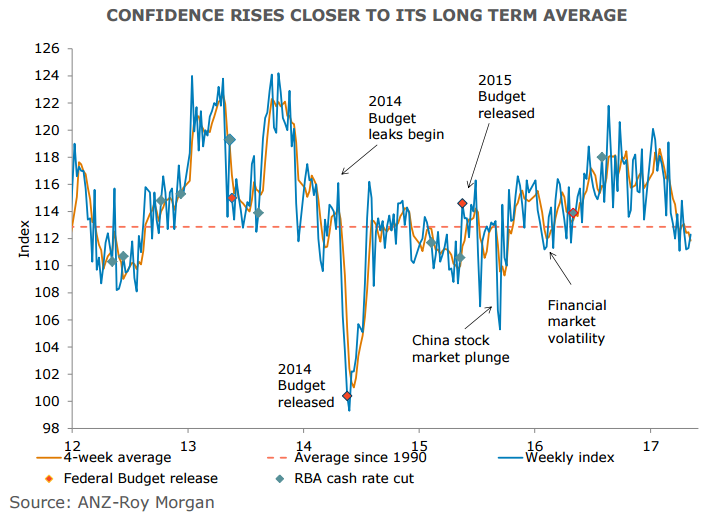

Australia's consumer confidence ticked up a modest 0.9 percent in the week ending 7 May, data released earlier today showed. The index edged higher to 112.3 – just below its long term average. Households’ near and long term economic outlook posted solid increases of 5.0 percent and 4.9 percent respectively.

Confidence around current finances fell 3.3 percent erasing previous week's 2.6 percent rise. Meanwhile, views about future finances rose a modest 1.2 percent, partially reversing its previous 3.6 percent fall. The ‘good time to buy a household item’ fell 1.7 percent to its lowest level since early 2016. While the weekly measure of inflation expectations ticked down to 4.4 percent from 4.6 percent last week, the four week moving average remains unchanged.

“The stabilisation in consumer confidence after a period of trend decline is encouraging, albeit at levels below the long term average. This stabilisation may be a sign of an improving labour market. ANZ Job Ads and other business surveys point to further gains in employment in coming months, following on from the strong result in March," said ANZ in a report.

Retail sales disappointed in both March and Q1, with soft volumes and weak retail inflation. Retail sales unexpectedly fell for the second consecutive month, with nominal sales falling 0.1 percent in March, from a downwardly revised February. Real quarterly retail sales were also below consensus expectations, up just 0.1 percent q/q (from a downwardly revised 0.7 percent q/q in Q4 2016), setting up a weak base for Q1 GDP.

Consumption which accounts for 60 percent of Australia's economy is closely watched by the Reserve Bank of Australia (RBA). The recent speech by RBA Governor Lowe highlighted the Bank’s growing concern about the vulnerability of the economy to shocks to the household sector given the high level of indebtedness. ANZ noted that soft retail sales data is consistent with the earlier research that the household saving rate is likely to have risen in Q1.

In Prime Minister Malcolm Turnbull's first budget after being re-elected on a tiny majority last year saw the government has found money for infrastructure, removed AUD13bn of “zombie” policy measures and tinkered with housing affordability. The underlying cash balance is estimated to be –AUD29.4bn (-1.6percent of GDP) in 2017-18. The deficit is projected to shrink in each of the following three years and be broadly in balance in 2020-21.

Aussie dumped across the board after retail sales miss. Housing market concerns and the weakness in the commodity prices likely to keep downside pressure. AUD/USD hit fresh 4-month lows at 0.7328, but has recovered some losses to currently trade at 0.7355. Technical studies are bearish. We see scope for further downside. The pair has broken below 61.8% Fib retrace of 0.7160 to 0.7749 rally and is on track to test 78.6% Fib at 0.7286.

FxWirePro's Hourly AUD Spot Index was at 1.1415 (Neutral), while Hourly USD Spot Index was at 95.2758 (Bullish) at 1150 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady