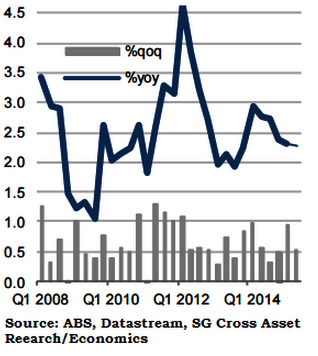

Most components of demand are expected to have grown more strongly or at a similar pace to the first quarter, but overall GDP growth in Australia is expected to have slowed substantially in Q2.

"The reason is that net exports, which have recently accounted for about half of overall growth, are expected to have swung from contributing 0.5pp to quarterly growth in Q1 to zero in Q2. Indeed, the risks are probably skewed slightly to the downside. Imports were slightly down in real terms, but exports also retrace d some of their spectacular increase of 5.0% qoq (not annualised) in Q1", says Societe Generale.

Meanwhile, final domestic demand is expected to have held up fairly well. Judging by retail sales, private consumption probably accelerated slightly, supported by strong employment and growth in real wages. Arguably the most watched component of demand, fixed investment given the steep adjustment in the mining sector, is likely to have expanded, albeit only weakly, thanks to a surge in private sector engineering work related to mining activity.

"This is likely to be only a short-lived interruption of the downward adjustment. Similarly, a pull-back in residential investment is also likely to be a one-off deviation from its rising trend. Lastly, government consumption, notwithstanding all the talk of budget consolidation, is likely to have continued to grow a little below 2% - though public investment remains very weak", anticipates Societe Generale.

All in all, the economy should have expanded at an average annualised pace of 3.0% in the first half, which is in line, or just above, its potential rate.

Australia's economic slowdown as net exports take a breather

Tuesday, September 1, 2015 5:32 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Rebound as U.S. Tariffs, Fed Policy and Iran Talks Drive Market Sentiment

Gold Prices Rebound as U.S. Tariffs, Fed Policy and Iran Talks Drive Market Sentiment  Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock

Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data

BOJ Signals Possible April Rate Hike as Ueda Eyes Inflation and Wage Growth Data  Global Markets Reel as Euro Falls, Swiss Franc Surges and Oil Prices Spike After U.S.-Israel Strike on Iran

Global Markets Reel as Euro Falls, Swiss Franc Surges and Oil Prices Spike After U.S.-Israel Strike on Iran  IMF Urges U.S. to Cut Fiscal Deficit to Reduce Trade and Current Account Gaps

IMF Urges U.S. to Cut Fiscal Deficit to Reduce Trade and Current Account Gaps  Asian Stocks Rise on Nvidia Earnings Boost; Yen Weakens as BOJ Rate Outlook Clouds

Asian Stocks Rise on Nvidia Earnings Boost; Yen Weakens as BOJ Rate Outlook Clouds