CAD/JPY gained slightly after the BOC monetary policy. It hits an low of 111.72 and is currently trading around 113.22.

The Bank of Canada kept its policy rate at 2¼% on January 28, 2026, considering it right given modest near-term growth predicted at 1.1% for 2026 brought on by slowing population and US protectionism changes supported consumer spending, corporate investment, and fiscal policy. Rising to 2.4% in December from base effects, CPI inflation dropped to ~2.5%, expected to remain near the 2% target as excessive supply offsets trade expenses; Ready to react if the outlook changes, the Governing Council emphasizes dual mandate in the face of increased volatility from CUSMA review and worldwide disturbance.

Technical Analysis

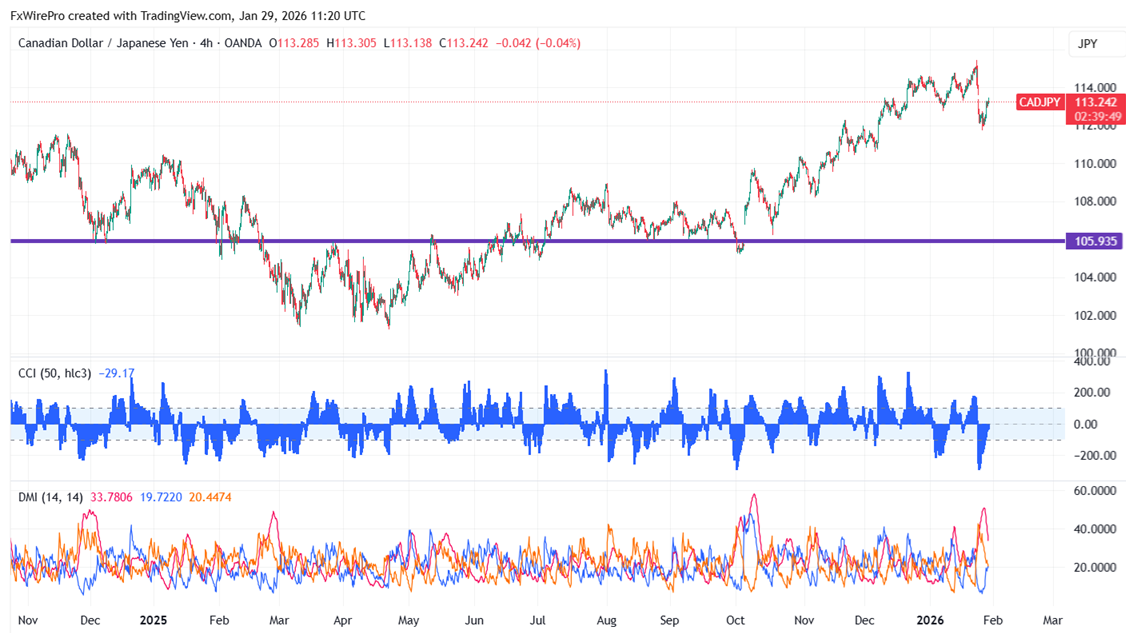

CAD/JPY is currently trading above the 34- and 55-EMA and below 200 EMA and 365 EMA on the 4-hour chart. The immediate resistance is at 113.67; a breach above that level could shift targets to 114/115/116/116.91. On the lower side, near-term support is at 112.60,and a break below this support could lead to declines toward 112/111.69/ 111/110.50/110/109.50/109.

Indicator Trends

CCI (50)- Bearish

ADX (14)- Neutral

Trading Strategy Recommendation

It is good to buy on dips around 113 with a stop-loss at 112 for a target price of 115.

FxWirePro: EUR/ NZD stays range-bound but maintains bearish bias

FxWirePro: EUR/ NZD stays range-bound but maintains bearish bias  Euro's Ascent: EURJPY Bulls Eye 186.00 as Yen Weakness Persists

Euro's Ascent: EURJPY Bulls Eye 186.00 as Yen Weakness Persists  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: GBP/NZD topside capped, sellers still hold the advantage

FxWirePro: GBP/NZD topside capped, sellers still hold the advantage  FxWirePro: EUR/AUD falls below 1.6200 level, plunge to test a key fibo grows

FxWirePro: EUR/AUD falls below 1.6200 level, plunge to test a key fibo grows  FxWirePro: GBP/AUD under pressure , knocking on door of key support

FxWirePro: GBP/AUD under pressure , knocking on door of key support  Bitcoin’s Tug-of-War: Institutional Inflows Battle Technical Resistance at USD 72,500

Bitcoin’s Tug-of-War: Institutional Inflows Battle Technical Resistance at USD 72,500  AUDJPY Bullish Momentum Pauses: Profit Booking Offers Fresh Entry Window Near 112.50

AUDJPY Bullish Momentum Pauses: Profit Booking Offers Fresh Entry Window Near 112.50  FxWirePro: USD/ZAR uptrend resumes rise toward key fibo

FxWirePro: USD/ZAR uptrend resumes rise toward key fibo  FxWirePro: USD/CNY recovers slightly from early decline but bears are not done yet

FxWirePro: USD/CNY recovers slightly from early decline but bears are not done yet  FxWirePro: GBP/USD drops towards 1.3350 level, heads deeper into bear territory

FxWirePro: GBP/USD drops towards 1.3350 level, heads deeper into bear territory  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  NZDJPY Holds Firm: Bullish Bias Intact Despite Temporary Top at 94.18

NZDJPY Holds Firm: Bullish Bias Intact Despite Temporary Top at 94.18  FxWirePro: USD/CAD recovers slightly but bearish outlook persists

FxWirePro: USD/CAD recovers slightly but bearish outlook persists  Pound Under Pressure: GBPJPY Pauses Five-Day Rally for Tactical Profit Booking

Pound Under Pressure: GBPJPY Pauses Five-Day Rally for Tactical Profit Booking