The Eighth Circuit Court of Appeals has blocked the president’s student debt relief plan, which aimed to cancel a substantial portion of millions of Americans' student loan debt. The ruling has quickly become a flashpoint in the ongoing national debate over the future of student debt, dividing the public and political leaders along familiar lines.

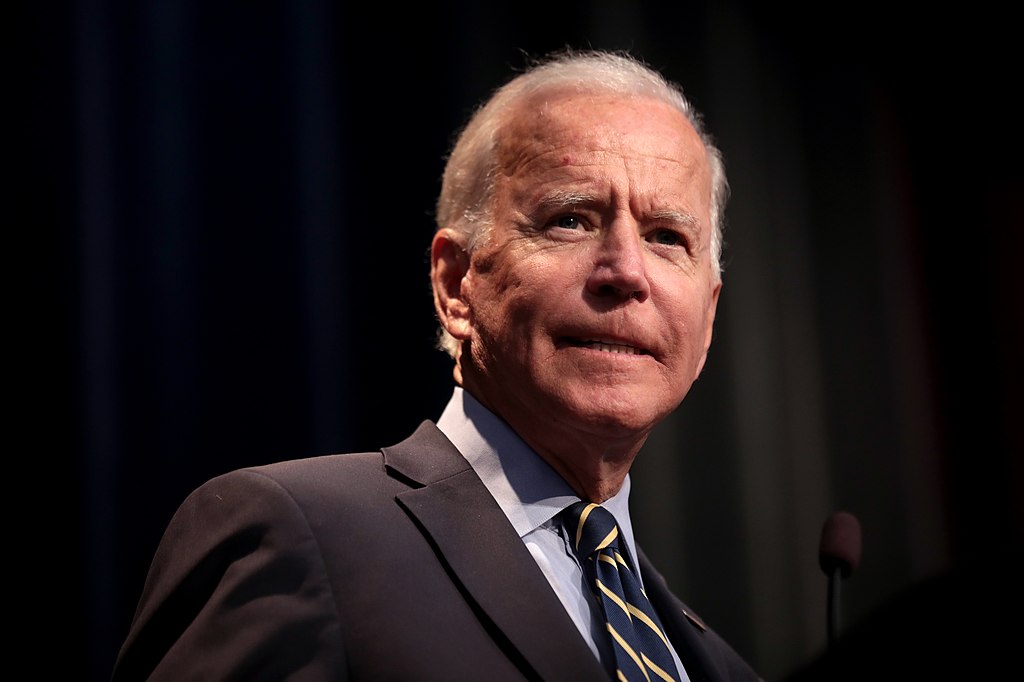

After months of anticipation and legal wrangling, the court's decision has left many borrowers in limbo, uncertain about whether they will see any relief from the crushing debt burdens that have become a defining issue for a generation of Americans. The Biden administration’s plan, which promised to cancel up to $20,000 in student debt per borrower, was heralded by supporters as a much-needed reprieve for those struggling under the weight of educational loans. However, opponents of the plan have consistently argued that it overreaches the administration's authority and unfairly burdens taxpayers.

The ruling by the Eighth Circuit Court has been met with a mixed response. Supporters of the court’s decision view it as a victory for the rule of law and fiscal responsibility. They argue that the executive branch does not have the power to cancel debt on such a massive scale unilaterally and that doing so would set a dangerous precedent. For these critics, the court’s intervention is a necessary check on presidential authority and a protection for taxpayers who would ultimately bear the cost of the proposed relief.

On the other side of the debate, advocates for student debt relief have condemned the court’s decision as a significant blow to millions of borrowers struggling to make ends meet. They argue that student debt is a national crisis that disproportionately affects lower-income and minority borrowers and that the Biden administration’s plan is a crucial step toward addressing this inequality. The court’s ruling, they say, only exacerbates the financial challenges millions of Americans face and delays the long-overdue relief that could help boost the economy by freeing up disposable income.

The legal battle over student debt relief is far from over. The Biden administration is expected to appeal the Eighth Circuit’s decision, potentially bringing the case before the Supreme Court. If the case does reach the nation’s highest court, it could set a precedent with far-reaching implications for both executive power and the future of student loan policies in the United States.

As the debate intensifies, student debt remains a deeply polarizing topic in American politics. The court’s decision has not only thrown the future of Biden’s relief plan into uncertainty but also reignited broader discussions about the role of government in addressing economic inequality and the fairness of placing the burden of higher education costs on individual borrowers.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions