Dollar index trading at 93.53 (-0.32%)

Strength meter (today so far) – Aussie -0.50%, Kiwi +0.40%, Loonie -0.08%

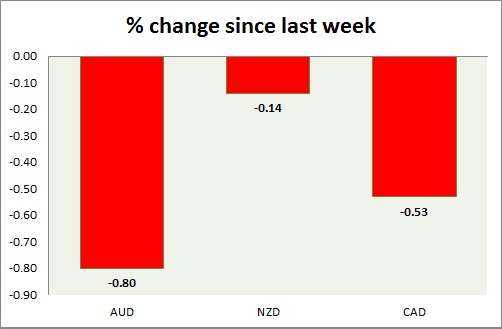

Strength meter (since last week) – Aussie -0.80%, Kiwi -0.14%, Loonie -0.53%

AUD/USD –

Trading at 0.759

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 0.746, Medium term – 0.765 (testing), Short term – 0.765 (testing)

Resistance –

- Long term – 0.825, Medium term – 0.825, Short term – 0.8

Economic release today –

- Wage price index is up 0.5 percent in the third quarter, up 2 percent from a year ago,

Commentary –

- Aussie is down this week on weaker commodity outlook.

NZD/USD –

Trading at 0.69

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.66, Medium term – 0.68, Short term – 0.68

Resistance –

- Long term – 0.76, Medium term – 0.76, Short term – 0.725

Economic release today –

- NIL

Commentary –

- Kiwi is consolidating around 0.69 area and is likely to decline towards 0.64 area.

USD/CAD –

Trading at 1.275

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.2, Medium term – 1.22, Short term – 1.246

Resistance –

- Long term – 1.355, Medium term – 1.32, Short term – 1.28

Economic release today –

- NIL

Commentary –

- Loonie is down this week on stronger dollar, NAFTA uncertainty, and relatively weaker oil price.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022