Dollar index trading at 93.31 (+0.25%)

Strength meter (today so far) – Aussie +0.10%, Kiwi +0.18%, Loonie +0.08%

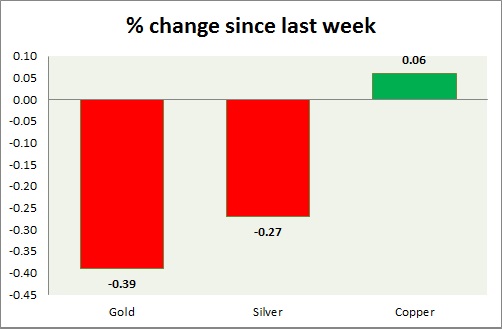

Strength meter (since last week) – Aussie -0.39%, Kiwi -0.27%, Loonie +0.06%

AUD/USD –

Trading at 0.761

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 0.746, Medium term – 0.75, Short term – 0.765 (broken)

Resistance –

- Long term – 0.825, Medium term – 0.8, Short term – 0.78

Economic release today –

- Current account balance for the third quarter came at -9.1 billion.

- Retail sales up 0.5 percent in October.

- RBA kept interest rates unchanged at 1.5 percent.

Commentary –

- Aussie is down today despite higher iron ore price as the dollar recovers.

NZD/USD –

Trading at 0.687

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.66, Medium term – 0.68, Short term – 0.69 (testing)

Resistance –

- Long term – 0.76, Medium term – 0.76, Short term – 0.725

Economic release today –

- ANZ commodity price down 0.9 percent in November.

Commentary –

- Kiwi is consolidating around 0.69 area and is likely to decline towards 0.64 area. It is the worst performer among commodity currencies.

USD/CAD –

Trading at 1.267

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.2, Medium term – 1.22, Short term – 1.246

Resistance –

- Long term – 1.355, Medium term – 1.32, Short term – 1.28 (testing)

Economic release today –

- October trade balance came at -$1,47 billion.

Commentary –

- Loonie is retracing today after big gains on Friday over jobs report.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX