Dollar index trading at 97.27 (+0.33%)

Strength meter (today so far) – Aussie -0.15%, Kiwi -0.59%, Loonie -0.36%

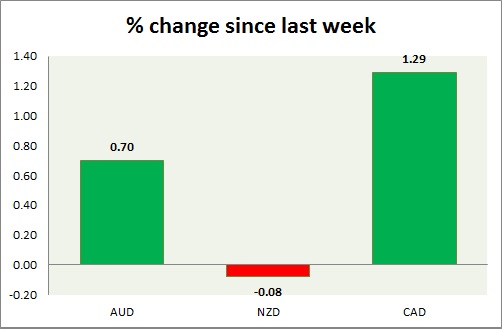

Strength meter (since last week) – Aussie +0.23%, Kiwi -0.12%, Loonie +0.23%

AUD/USD –

Trading at 0.758

Trend meter –

- Long term – Range, Medium term – Sell, Short term – Range

Support –

- Long term – 0.71, Medium term – 0.73, Short term – 0.73

Resistance –

- Long term – 0.782, Medium term – 0.78, Short term – 0.755 (testing)

Economic release today –

- Consumer inflation expectations declined to 3.6 percent in June from 4 percent last month. Employment rose by 42,000, largely driven by full-time employment. The unemployment rate declined to 5.5 percent.

Commentary –

- Aussie is down today as the dollar recovers on hawkish Fed. Aussie might decline to 0.72 area once more to test support.

NZD/USD –

Trading at 0.72

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range

Support –

- Long term – 0.66, Medium term – 0.67, Short term – 0.69

Resistance –

- Long term – 0.76, Medium term – 0.73, Short term – 0.723

Economic release today –

- Business PMI report will be released at 22:30 GMT.

Commentary –

- Kiwi has once again failed at the key resistance around 0.723 area.

USD/CAD –

Trading at 1.329

Trend meter –

- Long term – sell, Medium term – buy, Short term – Range/buy

Support –

- Long term – 1.32, Medium term – 1.32, Short term – 1.32 (testing)

Resistance –

- Long term – 1.38, Medium term – 1.37, Short term – 1.35

Economic release today –

- Manufacturing shipments reports will be released at 12:30 GMT.

Commentary –

- Loonie is still the best performer of the week on rate hike speculations from BoC.