Dollar index trading at 95.1 (+0.37%)

Strength meter (today so far) – Aussie -0.45%, Kiwi -0.35%, Loonie -0.41%

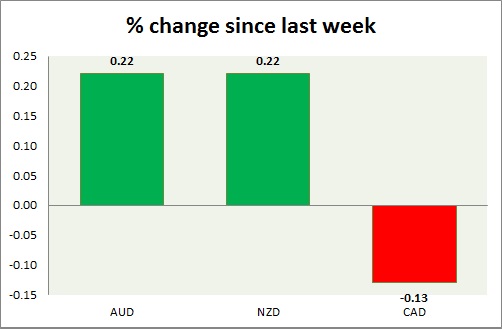

Strength meter (since last week) – Aussie +0.22%, Kiwi +0.22%, Loonie -0.13%

AUD/USD –

Trading at 0.765

Trend meter –

- Long term – Range/Buy, Medium term – Buy, Short term – Range/Sell

Support –

- Long term – 0.746, Medium term – 0.765 (testing), Short term – 0.77 (testing)

Resistance –

- Long term – 0.825, Medium term – 0.825, Short term – 0.8

Economic release today –

- RBA kept monetary policy unchanged at today’s meeting.

Commentary –

- Aussie is down today but up this week as iron ore price up in China trading.

NZD/USD –

Trading at 0.691

Trend meter –

- Long term – Sell, Medium term – Sell, Short term – Range/Sell

Support –

- Long term – 0.66, Medium term – 0.68, Short term – 0.68

Resistance –

- Long term – 0.76, Medium term – 0.76, Short term – 0.725

Economic release today –

- Global dairy auction is scheduled today.

Commentary –

- Further decline in kiwi likely.

USD/CAD –

Trading at 1.277

Trend meter –

- Long term – sell, Medium term – sell, Short term – Range/Buy

Support –

- Long term – 1.2, Medium term – 1.22, Short term – 1.246

Resistance –

- Long term – 1.355, Medium term – 1.32, Short term – 1.3

Economic release today –

- BoC governor Stephen Poloz is scheduled to speak at 17:55 GMT.

Commentary –

- Loonie is the worst performer of the week over lumber dispute with the United States despite higher oil price.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022