Dollar index trading at 97.31 (+0.36%)

Strength meter (today so far) – Euro -0.47%, Franc -0.38%, Yen -0.55%, GBP +0.14%

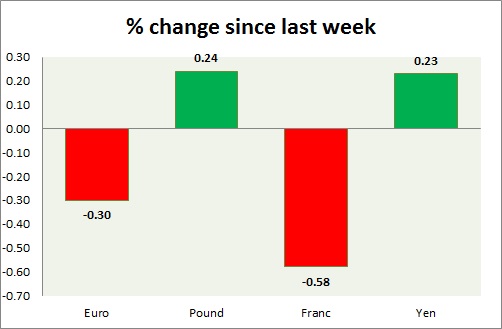

Strength meter (since last week) – Euro -0.30%, Franc -0.58%, Yen +0.23%, GBP +0.24%

EUR/USD –

Trading at 1.116

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Range/ Buy

Support

- Long term – 1.07, Medium term – 1.09, Short term – 1.10

Resistance –

- Long term – 1.16, Medium term – 1.14, Short term – 1.14

Economic release today –

- April trade balance came at €19.6 billion.

Commentary –

- The euro is down as the dollar rides hawkish FOMC.

GBP/USD –

Trading at 1.276

Trend meter –

- Long term – Sell, Medium term – Buy, Short term – Buy

Support –

- Long term – 1.16, Medium term – 1.23, Short term – 1.27

Resistance –

- Long term – 1.32, Medium term – 1.305, Short term – 1.305

Economic release today –

- Retail sales declined to just 0.9 percent y/y in May.

- BoE kept policy unchanged with three dissenters.

Commentary –

- Pound rose sharply after BoE announced rates on hold but with three dissenters looking for hikes. We expect the pound to reach parity in the longer run.

USD/JPY –

Trading at 110.1

Trend meter –

- Long term – Sell, Medium term – sell, Short term – Range

Support –

- Long term – 107, Medium term – 109, Short term – 109

Resistance –

- Long term – 119, Medium term – 115, Short term – 113

Economic release today –

- NIL

Commentary –

- The yen gave up earlier gains on stronger dollar.

USD/CHF –

Trading at 0.975

Trend meter –

- Long term – Buy, Medium term – Range/Buy, Short term – Range

Support –

- Long term – 0.92, Medium term – 0.95, Short term – 0.95

Resistance –

- Long term – 1.04, Medium term – 1.01, Short term – 0.98

Economic release today –

- Producer and import prices declined by 0.3 percent in May, up just 0.1 percent from a year ago.

- SNB kept policy unchanged at today’s meeting.

Commentary –

- Franc is the worst performer of the week.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed