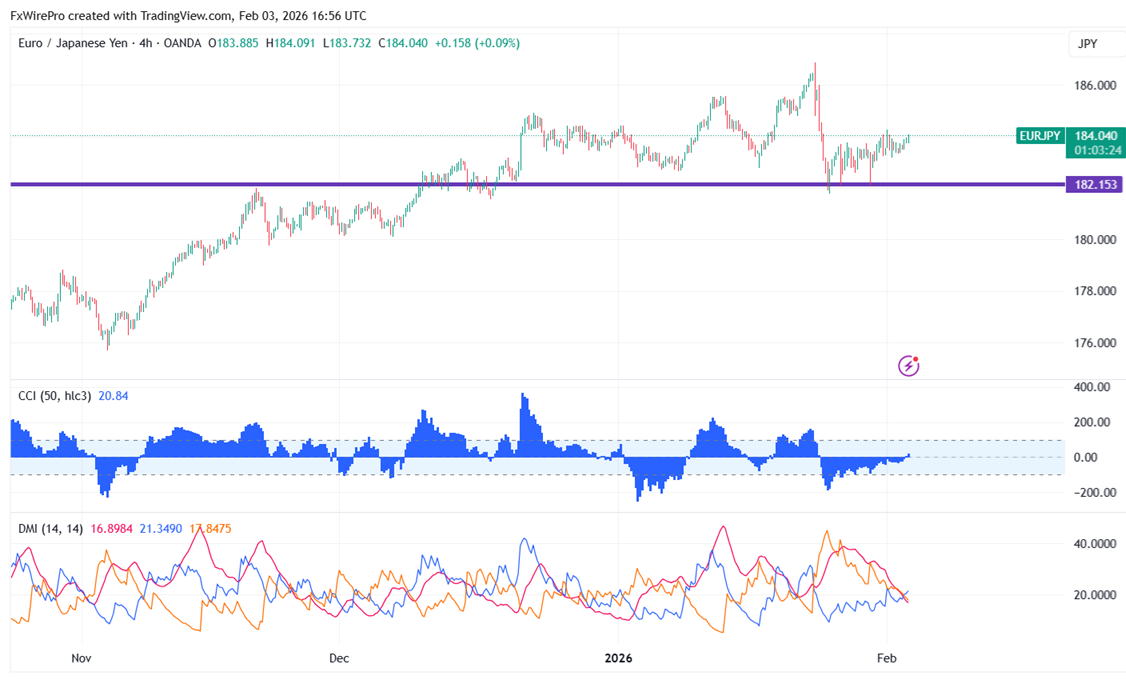

EURJPY trades above 184 as the Euro gains momentum. As long as it remains above 183, the trend for now is bullish. It is currently around 184.06 after hitting an intraday high of 184.09.

Technical Analysis:

The EUR/JPY pair is trading above 55 EMA, 200, and 365-H EMA on the 4-hour chart.

- Near-Term Resistance: Around 184.20,a breakout here could lead to targets at 184.92/186/187/188.69.

- Immediate Support: At 183, if breached, the pair could fall to 182/181.75/180.

Indicator Analysis (4- hour chart):

- CCI (50): Bullish

- Average Directional Movement Index: Neutral

Overall, the indicators suggest a neutral trend

Trading Recommendation:

It is good to buy on dips around 183.78-80 with a stop loss at 183 for a TP of 187.

FxWirePro- Major European Indices

FxWirePro- Major European Indices  Major European Indices

Major European Indices  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: USD/CAD extends gains, eyes 1.3800 level

FxWirePro: USD/CAD extends gains, eyes 1.3800 level  GBPJPY Roars Back 100 Pips — Bulls in Charge Above 210

GBPJPY Roars Back 100 Pips — Bulls in Charge Above 210  FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level

FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level  FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside

FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside  FxWirePro: USD/ZAR recovers slightly but bears are not done yet

FxWirePro: USD/ZAR recovers slightly but bears are not done yet  AUDJPY Powers Above 109 – Yen Weakness Fuels Aussie Bulls

AUDJPY Powers Above 109 – Yen Weakness Fuels Aussie Bulls  FxWirePro: USD/ZAR dips below lower range, bearish bias increases

FxWirePro: USD/ZAR dips below lower range, bearish bias increases  AUDJPY Bounces Back: Strategic Buy at 107 Targets 110

AUDJPY Bounces Back: Strategic Buy at 107 Targets 110  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside  EUR/GBP Slumps Under Pressure: Bearish Momentum Builds as 0.8675 Resistance Holds Firm

EUR/GBP Slumps Under Pressure: Bearish Momentum Builds as 0.8675 Resistance Holds Firm  FxWirePro: NZD/USD consolidating around 0.6030 , bias is bullish

FxWirePro: NZD/USD consolidating around 0.6030 , bias is bullish  NZDJPY Bulls Eye 95: Why Buying the Dip is the Strategic Play

NZDJPY Bulls Eye 95: Why Buying the Dip is the Strategic Play