This is continuation to previous posts of emerging market vulnerability.

It was explored companies across the emerging market issued dollar denominated debt since 2010 to explore the low interest rate cost and carry opportunities. Highest among the nations were China, Brazil, Mexico, turkey to name a few.

Chart courtesy BIS and Citi.

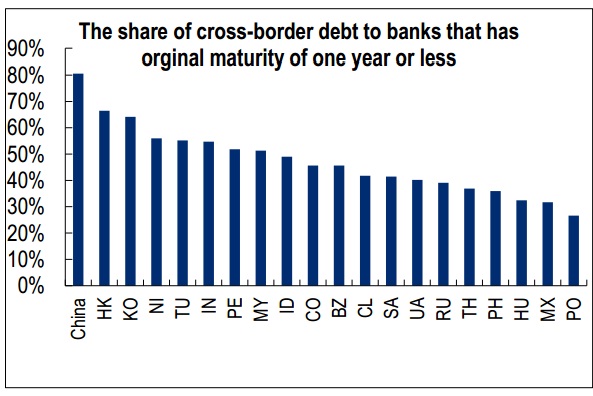

Today's article explores the maturity side of the debt viz. vulnerability in short term as explained in Chart.

China -

- The percentage of China's cross border debt is quite high compared to other emerging market counterparts close to 80%. These debts will mature in a year or less. These debts rose from $121 billion in 2009 to $ 850 billion in 2014 according to Citi.

- China's carry trade to benefit from interest rate differential faces hurdles when the currency fell 2.5% against dollar in 2014 first time in decades and prospect of a rate hike by FED rose.

- China remains extremely vulnerable to two developments; currency depreciation and fall in rate differentials. PBOC remains committed to further easing in contrast to FED.

- Rapid deterioration of either would hurt the companies and carry trades resulting in further winding effect.

- Some signs of strains were showing as China's capital account registered billions of outflow.

Others -

- Despite high percentage of shorter term debt, borrowing level is not high in all the markets.

- Mexico, Brazil and Turkey have the spot much weaker than others. Turkey has high short term borrowings in tune of 60% of total. Brazil and Mexico both have high foreign debt levels only dollar denominated debt is above 150 billion.

Impact -

- The companies and the carry players in these countries would shift towards Euro borrowing as cost is record low and yield differential is better.

- Rapid deterioration in yield differential and value of currencies, which are already suffering against dollar, would further escalate the problem for them.

- Dollar is expected to continue its rise against these vulnerable countries' currencies.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate