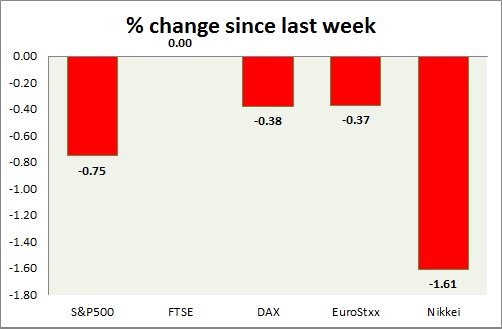

Equities are back trading in red today. Performance this week at a glance in chart & table -

S&P 500 -

- S&P future is down as FED hike looms after Jackson Hole comments. Today's range 1992-1962.

- Chicago PMI dropped to 54.4 In August, down from 54.7 in July.

- S&P 500 is currently trading at 1976. Immediate support lies at 1930 and resistance 2040.

FTSE -

- FTSE is closed over holiday.

DAX -

- DAX is marginally down today, thanks to rate hike bets in US. Today's range 10130-10330.

- DAX is currently trading at 10250. Immediate support lies at, 9500 area and resistance at 10500 around.

EuroStxx50 -

- Stocks across Europe are trading in red today.

- Germany is down (-0.38%), France's CAC40 is down (-0.60%), Italy's FTSE MIB is down (-0.45%), Portugal's PSI 20 is down (-0.65%), Spain's IBEX is down (-0.75%)

- EuroStxx50 is currently trading at 3270, down by -0.45% today. Support lies at 3000 and resistance at 3360.

Nikkei -

- Nikkei dropped thanks to heavy Asian selling. Today's range 18470-19070.

- Nikkei is currently trading at 18840, with support around 16000 and resistance at 19500.

|

S&P500 |

-0.75% |

|

FTSE |

+0.00% |

|

DAX |

-0.38% |

|

EuroStxx50 |

-0.37% |

|

Nikkei |

-1.61% |

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  Does international law still matter? The strike on the girls’ school in Iran shows why we need it

Does international law still matter? The strike on the girls’ school in Iran shows why we need it  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  The strikes on Iran show why quitting oil is more important than ever

The strikes on Iran show why quitting oil is more important than ever  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight