Ethereum reached a multi-month high, following Bitcoin's rise. It hit a peak of $3,446 and is currently trading at around $3,183.

Ethereum's Deflationary Trend

Ethereum has become deflationary again, with more ETH being burned than issued recently. Data from Ultrasound.money shows that the supply of Ethereum is decreasing as network activity increases, especially after recent market movements.

Current Supply Levels

As of November 12, 2024, Ethereum's total supply is about 120.42 million ETH, which is slightly down from previous days, showing ongoing deflationary pressure.

Market Implications of Decreased Supply

This reduction in supply is likely to increase Ethereum's scarcity, which could create positive momentum in the market. As rising transaction fees lead to more ETH being burned due to higher user activity, investors might expect the price to go up.

Growing Institutional Interest

Additionally, there is growing interest from institutional investors in Ethereum, with recent inflows into Ethereum ETFs reaching $649.3 million in just five days. This suggests that as more institutions see ETH as a valuable investment, the combination of decreasing supply and increasing interest could lead to higher prices.

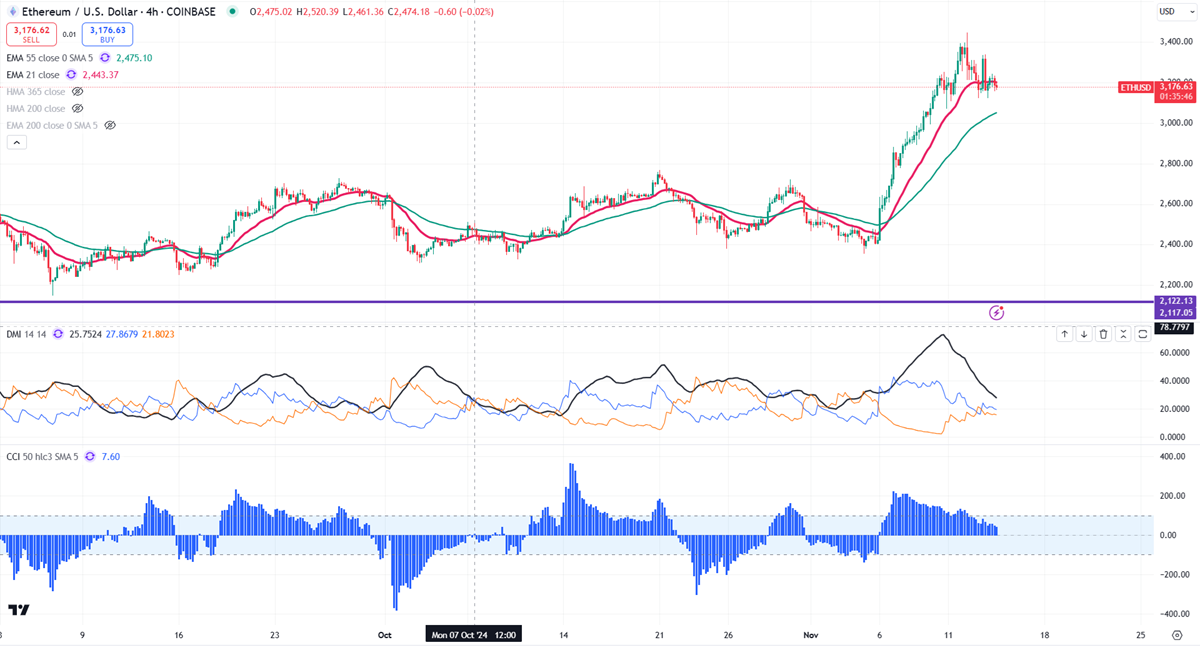

Technical Analysis: Resistance and Support Levels for Ethereum

Bullish momentum may be achievable if Ethereum maintains above $3,000. The key near-term resistance is at $3,000, with significant upward movement targeting $3,200 or even $3,400. A robust bullish trend will only materialize above $3,400.

Immediate Support Levels

Conversely, immediate support is around $2,770. A fall below this threshold will confirm continued bearish momentum, potentially leading to price drops to $2,500 or $2,300. A breach below $2,000 could see Ethereum plummet to $1,800.

Trading Strategies

Traders may consider buying on dips near $3000, with a stop loss set around $2770 and a target price of $4000.B

Bitcoin Crashes Below $65K: Bears in Full Control, Sell Rallies Now

Bitcoin Crashes Below $65K: Bears in Full Control, Sell Rallies Now  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K