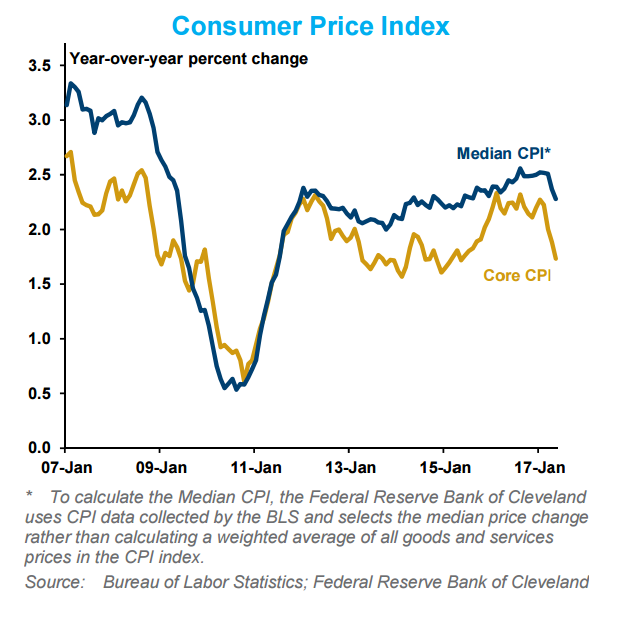

Despite the unexpected dip in US consumer Price Index and drop in retails sales in May, the Federal Reserve went on to raise US benchmark interest rate for the second time in three months and also forecasted one more rise this year with its rate-setting committee holding the view that a recent softness in inflation as largely transitory. The Fed raised benchmark lending rate to a target range of 1 percent to 1.25 percent. Also, Chair Janet Yellen brushed off the recent mixed data on the back of a robust labour market.

Data released by the US Labor Department last week showed Consumer Price Index dipped 0.1 percent last month, its second drop in three months followed a 0.2 percent rise in April. U.S. retail sales in May recorded their biggest drop in 16 months and consumer prices unexpectedly fell, suggesting a softening in domestic demand. The Fed seems intent on normalizing monetary policy, but a calm inflation environment could lead officials to slow the pace of adjustment or perhaps pull to the sideline.

U.S. consumer sentiment which had risen sharply in the months immediate after the presidential elections last year, has come off those highs since. The preliminary June estimate of the University of Michigan consumer sentiment index dropped three points to 94.5. The fall was widely based with the current conditions index that dropped to 109.6 from 111.7 and the future expectations index that fell to 84.7 from 87.7. That said, even at current lower levels, the survey is seen as indicating that consumer sentiment stays strong.

The survey showed that inflation expectations remained the same in June for the one year ahead measure at 2.6 percent and rose for the five-to-ten year ahead measure to 2.6 percent from 2.4 percent. Overall, the June report implies weakening in consumer enthusiasm. However, the sentiment at these levels are expected to be supportive of consumer spending in months ahead, noted Barclays in a research report.

"We suspect that monthly inflation rates will pick up in the near term as the influence of transitory factors fades. Thus, we continue to expect another tightening this year (probably September), and we expect the Fed to follow through with its plans for trimming the balance sheet later this year," said Daiwa Capital Markets in a report.

USD/JPY is consolidating the break above 200-DMA made last week. The pair initially fell after BoJ held interest rate last week, but pared losses to close largely unchanged on Friday. Technical indicators for the pair support upside, we see scope for test of cloud base at 111.81. Upside intact as long as pair holds above 200-DMA. The pair is currently hovering around 50-DMA at 111 levels, break above likely targets 100-DMA at 111.85. On the flipside, break below 200-DMA could see drag upto 109.11 (June 7 low).

FxWirePro's Hourly USD Spot Index was at -95.7366 (Bearish), while Hourly JPY Spot Index was at -121.757 (Bearish) at 1150 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence